In 2025, top industrial filter makers stand out for their advanced tech, wide product lines, and global reach. These companies push innovation and export power across air, liquid, hydraulic, and specialty filtration.

Major Global Industrial Filter Manufacturers

Europe

MANN+HUMMEL (Germany): Founded in 1914, this company makes high-performance air and liquid filters for cars and factories. They bought WIX Filters and FILTRON to grow. Their new project center in Poland helps link their production better.

Freudenberg Filtration Technologies (Germany): Started in 1849, Freudenberg is known for quality and tech innovation across many industries.

Camfil AB (Sweden): Camfil leads in high-efficiency air filters for factories, cleanrooms, and offices. They focus on green solutions and research.

EuroFilter Technologies GmbH (Germany): Makes industrial filtration systems with advanced filter cartridges for many sectors.

United States

Donaldson Company Inc.: A global leader. Donaldson made $3.3 billion in annual revenue. They export to cars, aerospace, manufacturing, and more.

3M Company: Known for many innovations and the Filtrete brand. 3M serves HVAC, personal, and industrial air filtration. They invest heavily in R&D and green practices.

Parker Hannifin: A major supplier of industrial and electronic filtration. Since 2020, they grew through new products and buying other companies.

Eaton Corporation: Offers different filtration solutions for complex factory and hydraulic systems.

Filtration Group Corporation: Active in R&D and buying other firms. Filtration Group serves medical, industrial, and commercial markets at large scale.

Culligan International, Omnipure: Focus on OEM/ODM water filtration for worldwide markets.

Asia

Hangzhou Hanzhikang Purification Equipment Co., Ltd. (China): Known for industrial filter parts and using advanced manufacturing tech.

Guangzhou KOMAI (KEFEI) Filters Co., Ltd. (China): A major Chinese exporter of car and industrial filters. They have a full product range and their own factories.

Japan Advanced Filter Systems (Japan): Provides advanced solutions in Japan and the Asia-Pacific area.

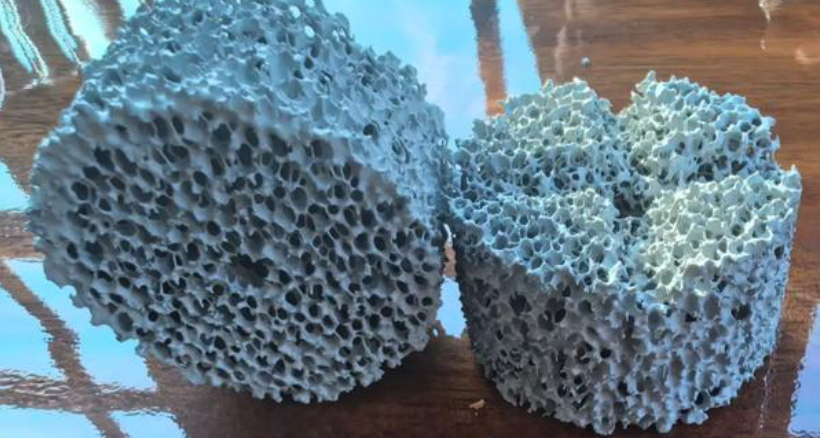

FoundryMax (China): They help China lead in production and export volume of industrial ceramic foam filters for foundry industry.

Market Data and Export Trends

By 2031, the industrial filter market should reach $52.36 billion. That’s a 4.9% growth rate each year from 2025. The air filtration part alone should grow from $37.2 billion (2025) to $64.8 billion (2035). That’s a 5.7% growth rate. I’ve noticed Donaldson Company leads in revenue. European and Asian firms do better in product variety and tech.

Distinctive Features and Competitive Strategies

R&D Commitment: Regular new products and big research spending keep innovation alive. This helps them stay competitive worldwide.

Product Portfolio Depth: These makers offer a full range—air, water, oil, hydraulic, electronic, and more. This serves broad factory needs.

Sustainability and Digitalization: Leaders focus on green filter materials. They also add more digital tech to their systems.

OEM/ODM Export Partnerships: Companies like A.O. Smith, Culligan, and Omnipure are big in custom manufacturing and export. I recommend looking at their water filtration tech if you need custom solutions.

Additional Influential Manufacturers

- Saint-Gobain (France): Uses material innovation for advanced and varied filtration solutions.

- Critical Process Filtration, Entegris, Cobetter Filtration, Mott Corporation, Porvair PLC: Focus on specialized filtration for electronics, healthcare, and industry.

- Hengst SE, Hollingsworth & Vose, Honeywell, Bosch, Samsung Electronics: Hold strong spots in cars, HVAC, appliances, and next-gen smart filters.

Based on my experience, these industry leaders shape the export landscape for industrial filters in 2025. They fuel sector growth, innovation, and global production network improvement.

Market Segments Served by Leading Industrial Filter Exporters

In 2025, the top industrial filter exporters serve many industries. I see this as a direct response to industrial growth and new global regulations. Their filter technologies meet specific needs in different sectors.

Key Market Segments

Automotive: Exporters offer advanced air and liquid filtration solutions. These help car makers meet tough emissions standards. In Europe and the US, modular filter systems are gaining popularity. They lower particulate emissions and ensure legal compliance.

Food & Beverage: Industrial filters play a vital role here. They purify water, clarify beverages, and remove particles during production. This keeps products safe and meets strict hygiene standards.

Chemicals & Petrochemicals: Filters remove impurities, treat wastewater, and maintain product purity. I recommend these filters for areas with strict environmental rules. Demand is high there.

Pharmaceuticals & Healthcare: This sector uses multi-stage liquid and HEPA-grade air filtration. These systems ensure batch integrity and ultra-clean packaging lines, including vaccine filling. High purity and contamination control drive this need.

Power Generation: Gas turbines, cooling water, and emission control all need filters. Based on my experience, the market wants strong, energy-efficient, and smart filtration systems.

Semiconductors & Electronics: This high-tech sector depends on nanofiber, ceramic, and membrane filters. They produce ultra-pure water, air, and chemical streams. This maintains cleanroom standards.

Metals, Mining & Minerals: Key uses include dust control, wastewater treatment, and process water filtration. These meet regulatory needs and protect machinery.

Oil & Gas: Exporters offer advanced membrane and sorbent filters. These process water, remove particles, and meet safety standards.

Paper, Paints & Pulp: Filtration removes solids from process flows and emissions. I see a growing push for sustainable and recyclable filter options.

General Manufacturing & Industrial Processing: Air and water filtration are common here. They ensure equipment safety and help meet compliance standards across different manufacturing settings.

Segment Trends and Technology Impacts

- In 2025, liquid filters made up 42% of the global industrial filtration market. Growth is fastest in food, beverage, chemical, and pharma sectors.

- Air filter media is a fast-growing segment. More attention to workplace air quality drives this.

- Smart filtration solutions are rising. They feature IoT, AI, and sensors. I suggest these for predictive maintenance and regulatory compliance.

- Nanofiber and ceramic filters gain more use in pharmaceutical recovery and semiconductor cleanrooms. High-purity demands drive this.

- The EU, USA, and Japan show strong demand across key sectors. Regulations and efficiency needs shape this.

Product Types & Application Models

- Filter Types: Bag, cartridge, depth, filter press, drum. Each one handles different particle or liquid-solid separation tasks.

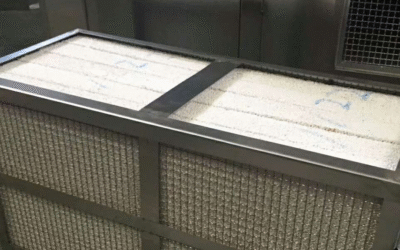

- Specialized Filters: HEPA and ULPA lead in cleanroom, healthcare, and advanced manufacturing.

- Filter Media Choices: Filter paper, fiberglass, activated carbon, and metals. Industry needs guide these selections.

Driving Forces and Customization

Stricter global regulations drive filter use in chemicals, pharma, and food. The US Clean Water Act and EU Industrial Emissions Directive lead this push. Growth in sustainable and recyclable materials is fast. I see this in organics, paper, and food processing. Exporters and makers focus on modular, custom systems. These handle varied production demands. Automotive and electronics benefit most.

Notable Technology and Industry Examples

In 2024, Cleanova released a modular filtration system for industrial fluids. It cut cartridge change-out frequency by 28%. Automotive and chemical firms adopted this fast. End-user bases stay strong in chemicals, pharmaceuticals, and power. Rapid expansion is happening in battery and hydrogen manufacturing.

Summary of Major Served Segments (2025):

Automotive, Food & Beverage, Chemicals & Petrochemicals, Pharmaceuticals & Healthcare, Power Generation, Semiconductors & Electronics, Metals, Mining & Minerals, Oil & Gas, Paper/Paints/Pulp, and General Manufacturing.

I believe this industry-wide growth and tech investment will help leading exporters expand their reach across all major industrial segments.

Global Market Outlook

I see strong growth ahead for the global industrial filters market in 2025 and beyond. The market value is projected between USD 37.9 billion and USD 38.25 billion for 2024. Based on my analysis, forecasts show expansion up to USD 52.36 billion by 2031. Some estimates go as high as USD 64.8 billion by 2035. Annual growth rates range from 4.1% to 5.7%. A 5.4% CAGR is expected to push the market to USD 50.79 billion by 2032. Filter demand across all product types could reach USD 112 billion by 2028.

Key Global Market Drivers

Regulatory Pressure: Stricter emission and environmental rules are driving change. Governments back clean air and water programs. This pushes rapid filter adoption.

Advancing Technology: I recommend watching IoT-enabled filter systems. Energy-optimized systems are growing fast. Smart systems can cut operational costs by 20–25%.

Industrial Expansion: Growth in Asia-Pacific fuels demand. China, India, Indonesia, and Vietnam lead this trend. Urbanization drives sustained need.

Industry Applications: Multiple sectors expand the market. Pharma, food & beverage, automotive, chemicals, semiconductors, and utilities all drive growth.

Regional Trends & Export Hotspots

North America: This region holds about 40% of global revenue (2024). I attribute this to advanced manufacturing. High environmental standards matter here. Premium filtration technologies are preferred.

Asia-Pacific: I see the fastest market growth here. New manufacturing bases drive this. Industrial policy helps. ASEAN, India, and China lead expansion.

Emerging Markets: Latin America, Middle East, and Africa add value. New installations grow the market. These regions focus on new projects, not just replacements.

Technology and Product Insights

Filter Media Leadership: Fiberglass filters lead the market. They offer durability. They resist corrosion. Thermal performance is strong. Power, chemicals, and water industries use them most.

Dominant Types:

- Dust collectors: Hold about 36.9% market share (2025). Cement and metal sectors prefer these.

- HEPA, baghouse, and cartridge filters: High-efficiency needs drive demand. Specialized applications grow.

- Smart and IoT-integrated systems: I suggest investing here. Real-time monitoring is valuable. Predictive maintenance saves money. Emission control improves.

Industry Segment Breakdown

Key Applications: Energy production uses filters heavily. Industrial machinery needs them. Robots, motors, and material handling depend on filters. Construction equipment and HVAC remain top users.

Food & Beverage: This segment held a big share in 2023. I expect further increases. Global hygiene rules get stricter. Safety standards tighten.

Material and Sustainability Trends: Activated carbon plays a role. Metallic filter media matter. Fiberglass is crucial. I like fiberglass for its versatility. Its resilience makes it dominant.

Notable Innovation and Market Shifts

K&N Engineering launched a new air filtration group in 2023. It targets data centers. This marks entry into new verticals. Greener infrastructure gains ground. I see emphasis on automatic, smart, and modular filters. Manufacturers serve high-contamination sectors. Steel needs them. Mining requires them. Oil & gas and broader manufacturing use them. Regulations are tight in these areas. Mature regions replace filters more often. Developing markets install new systems. Growth comes from installations. I recommend watching semiconductors. Pharma expands use. Municipal utility systems grow.

2025 and Beyond: Filter Market Trends

Automatic filters gain fast adoption. Smart industrial filters grow. New application areas expand. Semiconductors use more filters. Pharma needs them. Food hygiene requires them. Utilities adopt them. Established economies replace filters more often. Emerging regions drive volume growth. New projects expand the market.

Based on my experience, the global outlook for industrial filters in 2025 shows strong growth. Regulatory demands shape this. Technology advances drive it. Regional industrialization matters. I see continual innovation in filter products and materials. This creates a dynamic market landscape.

Competitive Advantages of Leading Industrial Filter Exporters

Top industrial filter exporters in 2025 stand out through innovation, strong operations, and global reach. Here are the competitive advantages that shape their success:

Technological Leadership and Innovation

Advanced Filter Materials and Designs: Exporters use new membrane materials, nanofibers, and nanostructured adsorbents. These materials remove contaminants better. They also make filters last longer. Process reliability improves too.

Digital Integration: Real-time sensor networks are now standard. Predictive maintenance algorithms are common as well. Exporters offer filters with optimized replacement cycles. This cuts downtime. It boosts operational efficiency.

Cutting-Edge R&D: R&D investment drives new modular designs. It creates specialty filters too. Companies adapt quickly to industry needs. They respond fast to regulation changes.

Strategic Partnerships and Expansion

Alliances with Technology Leaders: Exporters partner with automation firms. They work with sensor companies. Material science firms join in too. These partnerships speed up digital monitoring adoption. Analytics improve. Filter media reaches the next level.

Acquisitive Expansion: Companies buy regional players. They set up new production plants. For example, OFI Filters opened a factory in Jiaxing. This factory focuses on electric vehicle filtration technologies.

Regulatory Adaptation and Chain Resilience

Adaptability to Tariffs and Regulations: New US tariffs hit stainless steel and polymers. Major exporters respond by investing in local manufacturing. They diversify their suppliers. This ensures stable global availability.

Compliance and Certification: Exporters meet evolving environmental regulations. They follow safety standards closely. I’ve seen this position them as trustworthy partners for regulated sectors.

Sustainability and Environmental Focus

Green Solutions: I believe sustainability drives filter development today. Firms like Dupure lead with recyclable filtration systems. Their products save energy. They meet strict international standards.

Market Data Support: In 2025, coated filter media will make up over 61.98% of North America’s market. This shows strong industry preference for durable, sustainable solutions.

Commercial Infrastructure

Global Distribution Networks: Strong networks in Europe and North America ensure quick delivery. Product availability stays consistent. After-sales support remains solid.

Scalability: Modular platforms allow fast deployment. They adapt flexibly to local requirements.

Data and Regional Strengths

Market Size: The global industrial filtration market is valued between USD 33.25 billion (2024) and USD 35.03 billion (2025). It’s projected to reach USD 63.23 billion by 2034.

Growth Rates: The air filtration segment expects a CAGR of 5.7%. It will reach USD 64.8 billion by 2035. China’s industrial manufacturing value-added output grows at 3.59% CAGR. This boosts domestic demand. Export demand rises too.

Regional Technology Focus: Europe capitalizes on membrane advancements. It leads in catalyst technology. Asia-Pacific accelerates with government support. Rapid industrialization happens there. Pollution control expands.

Examples of Leadership in Action

Dupure: Uses recyclable, green filter media. This increases energy efficiency. Water efficiency goes up too.

OFI Filters: Expands in China. It provides advanced filtration for thermal management in electric vehicles.

North American Manufacturers: Deploy coated, nanofiber-based filters. These deliver outstanding efficiency. They meet regulatory compliance.

Key Exporter Advantages

- Technological differentiation (membrane, nanofiber, real-time sensors)

- Strong innovation networks and R&D-driven growth

- Chain resilience, with localization of production

- Focus on regulatory compliance and environmental sustainability

- Extensive infrastructure and global delivery capabilities

- Modular, flexible product platforms to reach multiple sectors

Based on my experience, these strengths allow leading exporters to deliver high-performance, regulation-ready solutions. They maintain chain stability in a competitive global market. I recommend looking at how these companies balance innovation with practical application. Their success comes from meeting real-world needs while staying ahead of regulations.