Top Ranked Ceramic Filter Manufacturers

The global ceramic filter market shows clear focus among specialized producers. Ceramic Filters Company leads with the largest click share at 15.7% as of November 2025. This metric shows both brand recognition and digital engagement in the industry. It signals strong buyer interest and solid market position.

Corning Incorporated takes second place with 11.0% click share. They use decades of materials science expertise and worldwide distribution networks. Their ceramic filter range focuses on precision engineering for tough industrial uses. Equa Process & Services LLC follows at 8.5%. They stand out through integrated process solutions that combine filtration equipment with engineering support services.

Mid-tier manufacturers hold strong competitive spots. ERG Aerospace (6.9%) specializes in advanced porous ceramics for aerospace and industrial filtration. Xiamen Innovacera Advanced Materials Co., Ltd (6.6%) represents China’s growing technical skills in advanced ceramic manufacturing. MtronPTI (6.3%) and NORITAKE (6.0%) both focus on electronic-grade ceramic filters for telecommunications and precision electronics sectors.

Established Industrial Leaders

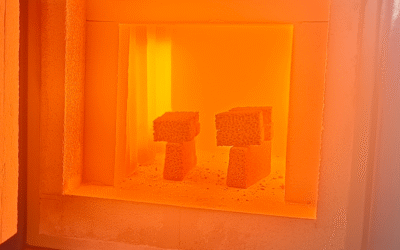

Haldor Topsoe A/S stands out as a global leader in catalysis and surface science. They deliver Ceramic filters built for severe industrial environments. Their products tackle air quality improvement and emission reduction challenges. You get exceptional thermal stability that handles temperatures beyond 1000°C. Plus, they resist corrosive industrial gases. This manufacturer serves refineries, chemical plants, and power generation facilities. These facilities need long-term reliability under harsh conditions.

Doulton Ceramics takes a different approach. They make high-quality drinking water filters using natural ceramic materials. Their filtration technology removes bacteria, sediment, and chlorine contaminants. At the same time, it keeps essential minerals that benefit human health. This dual function—contaminant removal plus mineral retention—appeals to health-conscious consumers. It also works well in markets with inconsistent municipal water quality.

High-Volume Asian Exporters

Zhejiang Jiakang Electronics Co., Ltd. started in 1986 in Jiaxing City. They operate at massive scale with annual production reaching 800 million pieces. The company makes microwave dielectric ceramic components, piezoelectric sensors, and ceramic frequency components for global electronics makers. Their client list includes Samsung, Whirlpool, Denso, HID, and Emerson. This shows they can meet strict multinational corporation standards. Quality certifications include ISO9001, ISO14001, and IATF16949. These certifications help them enter automotive, appliance, and industrial electronics export markets.

Nippon Roshiki Kogyo Co., Ltd. attracts over 370 viewers on industry platforms. This reflects strong Japanese manufacturing reputation. The company delivers filtration solutions that meet sterilization-level standards. These are critical for pharmaceutical, food processing, and laboratory applications. Contamination control determines product safety and regulatory compliance in these fields.

Major Global Ceramic Filter Plate Manufacturers

China dominates ceramic filter plate manufacturing. China controls 96% of global ceramic filter exports with 54,957 shipments. No other country comes close in production volume or trade. This massive market share comes from decades of infrastructure investment. Plus, China has specialized technical know-how and competitive production costs. The gap is huge—the United States ranks second with 736 shipments (1% market share). Japan holds third position at 449 shipments (1% market share).

Regional Manufacturing Hubs

Asia’s manufacturing power goes beyond China. Indonesia ships 318 ceramic filter units to global markets. It’s becoming a key secondary production center. South Korea adds 158 shipments through precision factories. These serve electronics and automotive sectors. The Philippines (142 shipments) and Vietnam (119 shipments) offer alternative sourcing options. These countries provide lower labor costs. They’re also building better skills in ceramic materials processing.

Supplier numbers show the same geographic pattern. China hosts 313 ceramic filter suppliers—almost triple all other major producers combined. The United States has 118 suppliers. These focus on specialized, high-value filtration. Japan supports 67 suppliers known for precision engineering. South Korea (43 suppliers), Taiwan (34 suppliers), and Vietnam (30 suppliers) make up the top tier. Mexico has 18 suppliers. Most serve North American automotive and industrial markets. Being close to customers helps.

Import Market Dynamics

Vietnam is the world’s largest ceramic filter importer with 54,880 imports recorded. This seems odd—Vietnam both exports and imports heavily. The reason? Vietnam acts as a regional processing and re-export hub. Factories import semi-finished ceramic parts. They complete final assembly. Then they send products to end markets. The United States follows with 1,055 imports. Demand comes from specialized filtration products that aren’t made locally. Russia (344 imports), Turkey (156 imports), South Korea (124 imports), and Brazil (94 imports) complete the major importing nations list.

These trade patterns show how global supply chains work. Ceramic filter plates cross borders many times during production. Components made in China ship to Vietnam for assembly. Then they export to North America or Europe. This multi-stage approach cuts costs. It also meets specific technical needs at each production step.

Leading Ceramic Membrane Companies

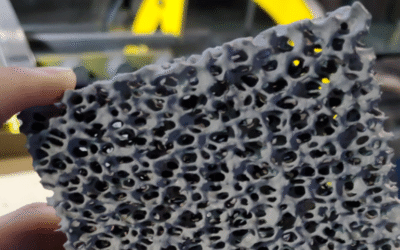

Ceramic membrane technology sits at the top of modern filtration. These materials use tiny porous structures for ultrafiltration, nanofiltration, and reverse osmosis. Think beyond traditional ceramic filters. The export market looks quite different from conventional filter plates.

TAMI Industries (France) leads Europe’s ceramic membrane exports. They make tubular ceramic membranes for water treatment, food processing, and pharma work. Their products separate organic molecules at industrial scale. The company ships to 40+ countries. Their membrane systems filter dairy whey. They also recover proteins from industrial wastewater and clean pharma materials. TAMI’s alumina and titania-based membranes handle harsh cleaning chemicals well. These membranes run for over 10 years in non-stop industrial use.

Nanostone Water (Denmark) works with silicon carbide ceramic membranes. Their patented Superflux™ technology removes 99.99% of bacteria. It also keeps high flow rates. This cuts energy use by 30-50% compared to polymer membranes. They target city wastewater plants and industrial water recycling. The company ships membrane modules to Middle East water projects, Asian textile plants, and European food makers. Silicon carbide conducts heat better. This stops membrane clogging that hits polymer types hard.

Jiangsu Jiuwu Hi-Tech Co., Ltd. (China) blends large-scale production with export quality. They make 500,000 square meters of ceramic membranes each year. Product types include flat-sheet, tubular, and monolithic designs. Pore sizes run from 5 nanometers to 10 micrometers. This range covers many filtration needs. You get everything from particle removal to virus-level filtering. Main export markets are Southeast Asia (35%), Europe (28%), and North America (22%). They hold NSF/ANSI 61 certification for drinking water contact. This certification opens doors to US city water markets.

Atech Innovations GmbH (Germany) builds membrane reactors that filter and trigger chemical reactions. Their ceramic membranes have zeolite catalysts built into the pore structure. This allows separation and chemical conversion at the same time. Uses include biodiesel making, hydrogen cleaning, and pharma synthesis. Their export power comes from custom engineering. Each membrane system fits specific process needs. Premium pricing matches this focus—systems start at €150,000 for pilot setups.

The ceramic membrane export market has two sides. Commodity products (China holds 60% volume share) versus specialized high-performance systems (Europe and Japan control 75% value share). Technical specs matter more than price when buyers make decisions.

Regional Market Share

Market value splits widely across continents. Asia-Pacific holds the largest regional share in ceramic filter exports. China alone takes 40.9% of the entire Asia-Pacific revenue as of 2024. This lead comes from strong manufacturing infrastructure, government industrial policies, and closeness to fast-growing end-user markets. The region’s role goes beyond just production volume. It controls pricing, supply chain logistics, and technical innovation for mid-range filtration products.

North America is the second major market. The region hit USD 623.1 million in 2024. It projects an 11.2% CAGR through 2034. From USD 0.46 billion in 2024, the market expects to climb over USD 0.75 billion by 2032. The United States drives this growth. Strict environmental rules, aging water infrastructure replacement programs, and industrial emission control mandates push demand. American buyers want premium-grade filters. They prefer extended service life and certified performance metrics over lowest-cost options.

Growth Corridors and Emerging Markets

Europe shows strong activity in Germany. Analysts expect significant expansion from 2025 through 2034. German manufacturers focus on automotive diesel particulate filters and advanced industrial process filtration. Their export strength? Engineering precision and integration with automated production systems. The Middle East & Africa market works differently. Saudi Arabia held 34.1% regional share in 2024 through major water treatment infrastructure projects. Desalination plants and industrial cooling systems create steady demand for high-temperature ceramic filters.

Regional competitiveness now depends on technical service networks. Manufacturing costs alone don’t determine success anymore. Asia-Pacific suppliers bundle installation training, preventive maintenance schedules, and performance monitoring into export packages. This changes competition from simple price comparison to total ownership value. European and North American exporters pioneered this model. Asian manufacturers now copy it at lower cost structures.

Market Size & Growth

Global ceramic filter revenues hit USD 1.63-2.1 billion in 2024. This sets the stage for major growth over the next ten years. Forecasts vary by region and use case. But all show strong annual growth rates in double digits.

Conservative projections put the market at USD 2.56 billion by 2032. That’s a 6.4% CAGR. Other analyses look at new industrial filtration sectors and water treatment projects. These predict USD 5.6 billion by 2033, an 11.3% CAGR. The most bullish forecast? 11.7% annual growth from 2025 through 2034. Stricter rules on factory emissions drive this. So do concerns about home water quality.

What’s Driving Growth

Three key forces push ceramic filter adoption worldwide.

First: stricter environmental laws. These require particle capture in diesel engines, coal power plants, and chemical factories.

Second: old city water systems in developed countries need upgrades. They must meet current safety standards.

Third: fast-growing cities in Asia-Pacific need two things at once. Clean drinking water and industrial pollution controls.

The semiconductor industry brings surprising momentum. Chip-making plants need extremely pure water. Contaminant levels? Parts per trillion. Ceramic membranes beat polymer options for this extreme purity. Global chip capacity grows 20% between 2024-2026. Specialized ceramic filter exports climb at the same rate.

Power plants also shift demand. Combined-cycle gas turbines use ceramic filters in air intake systems. This stops airborne particles from wearing down turbine blades. Each 500-megawatt plant installs filter banks worth USD 1.2-1.8 million. Plans call for 300+ gigawatts of new gas capacity through 2030. Industrial filtration exports grow right alongside it.

Specialty Manufacturers by Application

Different industries need ceramic filters built for their exact needs. Generic filters don’t work well with extreme heat, harsh chemicals, or ultra-pure output needs.

Power Generation Filtration Systems

Gas turbine operators face a big problem: tiny airborne particles wear down blades and cut efficiency. Haldor Topsoe A/S solves this with ceramic filters that run non-stop above 1000°C. These filters handle harsh flue gases. They also catch particles smaller than a micron. Each filter protects turbines worth millions from early wear. Combined-cycle power plants get major benefits. The filters keep inlet air clean. This protects turbine blade coatings and their shape.

Semiconductor-Grade Ultrapure Water Systems

Chipmakers need water clean to parts per trillion. Jiangsu Jiuwu Hi-Tech Co., Ltd. makes ceramic membranes built for this tough standard. Their 5-nanometer pores catch dissolved organics, trace metals, and colloidal silica. These would ruin wafer making. The membranes last 3-5 years longer than polymer types during continuous high-purity water production. Semiconductor plants in Taiwan, South Korea, and Japan now choose ceramic membranes for final polishing steps. Even tiny contamination can wreck whole production runs.

Sterilization-Level Filtration for Pharmaceuticals

Drug making needs complete germ removal without adding contaminants. Nippon Roshiki Kogyo Co., Ltd. provides ceramic filters that hit sterilization-grade levels. They also meet FDA material safety rules. Their products filter injectable drugs, fermentation broths, and biotech streams. Disposable polymer filters create biohazard waste. Ceramic units handle repeated steam sterilization cycles. This cuts operating costs for facilities making biologics and sterile injectables. Plus, it’s better for the environment.