The wrong ceramic filter supplier costs you more than money. It can shut down your entire precision casting operation. A Canadian aerospace manufacturer faced this reality. Defective filters caused a $340,000 batch rejection. Their production stopped for three weeks. Stakes run high with ceramic filter selection for precision casting. Most purchasing managers make the same mistake: they focus only on price or location.

How to choose the best ceramic filter supplier for Canada’s precision casting – it boils down to eight key factors. These factors separate top suppliers from those who cut corners on quality. This guide gives you a proven selection framework. You’ll learn the technical differences between Al2O3 and ZrO2 materials. You’ll see how to check structural integrity under extreme heat. Pore size specifications matter more than most engineers think. We’ll cover that. You’ll also get the real story on laminar flow versus foam filter performance. Plus, you’ll find an unbiased comparison of Canadian and North American suppliers. These are the ones who truly get the unique challenges of precision casting filtration.

Precision Casting Filtration Requirements in Canada

Canada’s precision casting industry follows strict rules. These rules shape which ceramic filters you can use. They’re not suggestions—they’re enforceable standards. Your operation runs well or shuts down based on these.

CSA Z317.2:24 and CSA Z8004:22 set the baseline for industrial filtration systems. These standards target healthcare facilities first. But precision casting operations serving aerospace and medical device sectors must meet similar requirements. Your Ceramic filters need proven efficiency ratings. These ratings must align with provincial emission controls.

Provincial emission regulations matter most here. Ontario demands ≥95% particulate capture efficiency from all exhaust systems. This covers your casting foundry’s dust collection systems. It covers fume extraction systems too. The ceramic filters you pick must hit this mark under real conditions—not just in labs.

The NFPA 33 fire code adds another layer for metal casting. Your ceramic filters must qualify as non-combustible materials. This cuts out certain cheaper filter options right away. The standard also needs documented maintenance protocols. You need spark arrestor integration for operations handling combustible metal dust.

ASHRAE 241’s 2023 update recommends MERV 13+ filtration for facilities that recirculate air to work areas. Precision casting differs from HVAC applications. But foundries recirculating conditioned air face the same expectations for worker safety.

Bottom line: Canadian ceramic filter suppliers who know these standards save you compliance headaches. Those who don’t? They cost you in failed inspections. They cause production delays.

Critical Filter Material Selection: Al2O3 vs ZrO2 for Different Alloys

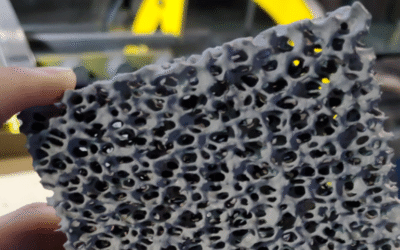

Your ceramic filter needs to survive the casting process. Pick the wrong material and it crumbles under molten metal. Two materials lead the precision casting filtration market: aluminum oxide (Al2O3) and zirconium dioxide (ZrO2). Each handles extreme heat and alloy types in its own way.

Al2O3 filters give you better size control. After sintering, pure alumina hits 99.9% density. It shrinks 13% during processing. Pure ZrO2 shrinks 18%—that’s a 38% difference. Precision casting needs tight size tolerances. This gap matters. Your filter dimensions stay predictable. Your mold cavity design stays accurate. Less shrinkage cuts down rejected parts.

ZrO2 works best at high temperatures with reactive alloys. The tetragonal phase stays stable above 1450°C. This makes zirconia perfect for filtering stainless steel, high-alloyed steel, and nickel-based superalloys. Canadian aerospace foundries casting Inconel 718 use ZrO2 filters for this reason. The material resists aggressive molten metals that destroy alumina.

Al2O3/ZrO2 composites split the difference for shops filtering multiple alloy types. A 90/10 vol.% blend (90% alumina, 10% zirconia) gives you alumina’s size control plus zirconia’s heat resistance. STEM analysis shows zero separation at phase boundaries. These composite filters hold together through repeated heat cycles.

Particle size data shows you quality at the powder stage. Premium Al2O3 powder specs show d50 = 100 nm with 99.99% purity. ZrO2 (TZ3 grade) runs finer at d50 = 40 nm, also 99.99% pure. Some suppliers cut corners. They use coarser powders with lower purity. Those filters fail faster under heat stress.

Match your alloy to your material. Unalloyed steel and low-alloyed steel work fine with pure Al2O3 filters. You save money without losing performance. Stainless steel, cobalt-based alloys, and nickel superalloys need ZrO2 or high-zirconia composites. The best ceramic filter supplier for Canada’s precision casting shops stocks both materials. They guide your choice based on what you actually make—not what they need to move off the shelf.

Choosing the Right Pore Size (PPI/CPSI) for Your Casting Process

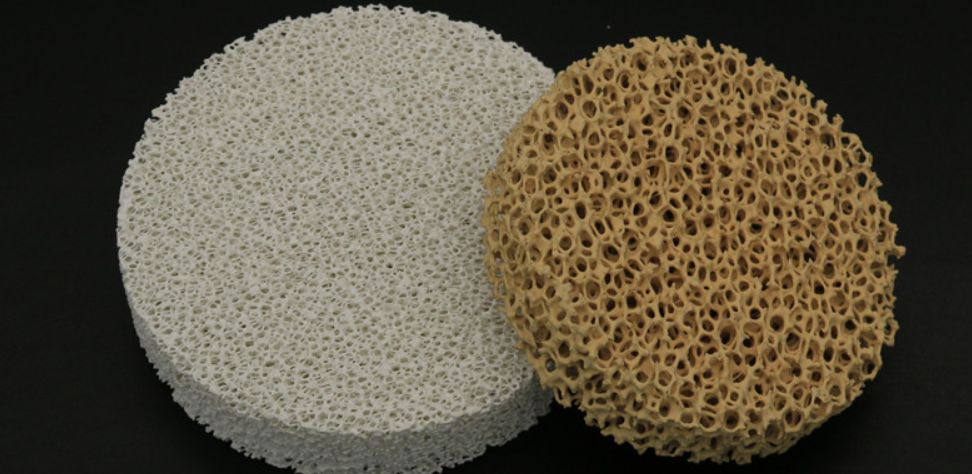

Pore size specs control your final casting quality more than material composition does. The filter’s pores either catch defects or let them through. There’s no middle ground. PPI (pores per inch) ratings show the defect sizes your operation can handle. Too coarse? Inclusions slip past. Too fine? Metal flow slows down. This creates cold shuts and misruns.

Aluminum casting operations need 10-40 PPI filters for standard inclusion control. Oxides and inclusions in aluminum melts range from a few micrometers to tens of micrometers. A 20 PPI ceramic foam filter catches most of these contaminants. Dealing with sub-micrometer impurities? Push toward 30-40 PPI. The finer mesh traps smaller particles. Plus, it won’t create too much back pressure.

die casting demands the tightest specs. Critical and sealing areas accept nothing larger than 0.5-1.0 mm diameter pores. Total porosity must stay under 0.5%. Density caps at 3 pieces per 25 cm². General die casting areas get more breathing room. You can go up to 2.0-2.5 mm single pore diameter with 1.5% total porosity. But you still can’t exceed 5 pieces per square inch for pores larger than 1 mm. Chain pores? Not allowed anywhere.

Sand casting follows ASTM E446 levels. These map to specific filter requirements. Level 2 (critical applications) allows maximum 1.5-2.0 mm single defects at 5-8 pieces per square inch. Area porosity caps at 1-2%. Depth limits stay at 1.2-2.0 mm. Commercial Level 3 tolerances jump to 2.5 mm diameter and 10 pieces per square inch. General Level 4 accepts up to 4.0 mm single defects at 12 pieces per square inch. Your ceramic filter’s pore structure should block defects at least one size category below your target ASTM level.

Match your filter PPI to your process reality. Die casting critical zones need filters blocking anything over 0.5 mm. Sand casting Level 2 work needs filters catching defects above 2.0 mm. The best ceramic filter suppliers stock multiple PPI ratings. They help you map industry standards to actual filter specs. No guessing based on generic charts.

Testing Filter Strength and Size Specs

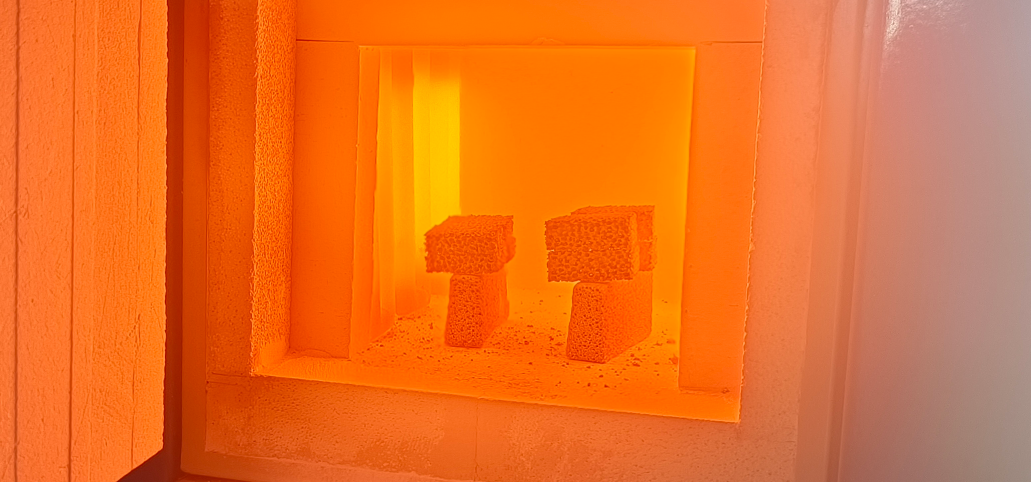

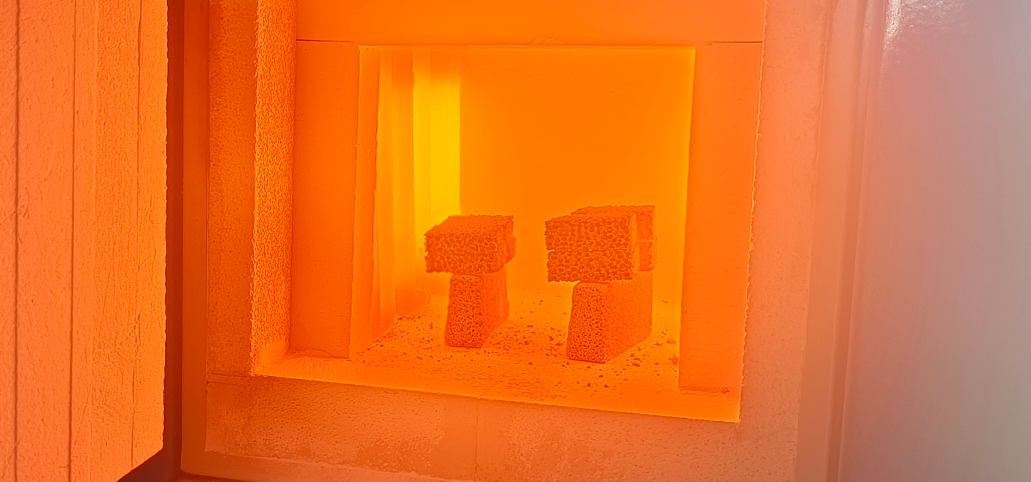

At 1450°C, structural failure happens without warning. A ceramic filter holds under molten metal pressure or it breaks. ISO 2941 collapse strength testing shows which outcome you’ll get. This standard measures the minimum pressure difference (∆P) before the structure fails. Labs increase pressure until the filter breaks. The result shows true resistance to pressure drops during casting.

Your filter must pass the bubble point test under ISO 2942 rules. Here’s the process: technicians put the filter in fluid and add pressure. They watch for the first bubble. That bubble means a leak or defect exists. The pressure reading at first bubble matches your filter’s largest pore size. Gas pushes through the wet membrane once pressure beats the smallest pore openings. No bubbles at spec pressure? Your filter passes quality checks.

Pressure hold testing finds stability issues that appear during long casting runs. Operators add set pressure to the filter. They track pressure loss over time with gauges. Fast pressure loss means your filter won’t hold up through a full work shift. Top ceramic filter suppliers for Canada’s casting shops provide documented pressure hold data. Cheap suppliers skip this test.

The beta filtration ratio from ISO 16889 multi-pass testing gives you absolute versus nominal ratings. A Beta(x)=75 rating shows the maximum reliable “absolute” filtration. Beta(x)=2 marks “nominal” ratings—just marketing numbers with little real meaning. Canadian foundries filtering aerospace alloys should demand Beta(x) ratings of 75 or higher.

Tensile strength testing finds hidden material flaws before they cause casting failures. This test measures maximum stress before the filter breaks. High temperatures matter most here. So do high pressure, harsh alloys, and reusable uses. DWTU standards add cyclic pressure tests and three types of water pressure tests. These copy real foundry conditions better than single measurements.

Top suppliers give you full test records: collapse strength, flow fatigue resistance, water burst limits, vibration strength, and impulse fatigue specs. Missing data? That’s a red flag.

Laminar Flow Technology vs Foam Filters: Performance Comparison

Two filtration technologies dominate precision casting in Canada: ceramic foam filters and laminar flow systems. Both remove inclusions. Both promise cleaner castings. But they work in opposite ways. One creates chaos that settles into order. The other keeps things uniform from start to finish.

Foam filters force turbulent flow that becomes laminar downstream. Molten metal hits the foam structure. The cellular network breaks the flow into thousands of tiny streams. Turbulence peaks inside the filter body. Then something interesting happens—the flow reorganizes into smooth patterns after exiting. This catches inclusions through depth filtration. Particles stick to internal surfaces as metal moves through the maze.

Laminar flow technology takes the opposite approach. It stops turbulence before it starts. The system keeps flow moving in one direction at constant speed across the entire filter area. No mixing. No chaotic paths. Particles get swept away from key zones through controlled air movement. Think prevention versus capture.

Performance gaps show up in consistency. Foam Filters struggle here. Even top makers can’t avoid batch-to-batch problems. The same PPI rating from the same supplier performs differently across production runs. Cell structure varies. Pore distribution shifts. Large casting operations using foam filters report 15-22% variation in filtration efficiency within single batches. Laminar systems deliver the same particle counts shift after shift.

Structural strength under pressure tells another story. foam filters work well for melt filtration but crack under high flow rates in large castings. The delicate ceramic foam can’t handle extreme stress. Breakage risk jumps above 50 kg/min pour rates. Laminar flow systems show no such weakness—they handle sustained high-volume operations.

Canadian aerospace foundries face a choice: foam filters for smaller precision castings under 25 kg, or laminar systems for large structural parts. Both technologies filter well. Your production volume and casting size determine which one works for your operation.

How to Pick North American Premium Suppliers for Specialized Needs

Top suppliers prove themselves with real performance numbers, not fancy marketing. North American automotive and industrial sectors use scoring systems that show what suppliers can actually do. Quality and warranty performance takes up 45% of total ratings. Delivery gets 25%. Premium freight, value engineering chances, and supplier support make up the remaining 30%.

Parts per million (PPM) defect rates show quality consistency. Suppliers shipping fewer than 1 PPM suspect parts earn the top 15-point rating. That’s aerospace-level precision. Most ceramic filter operations for Canadian precision casting should aim for this level. Suppliers running 1-6 PPM still score 12 points. This works fine for commercial casting. Defect rates above 300 PPM mean suppliers are cutting corners. Anything over 10,000 PPM gets zero points. Don’t work with those operations.

SCAR response quality shows how well suppliers solve problems. SCAR stands for Supplier Corrective Action Request. Good responses find root causes. They set up mistake-proofing systems. They create zero warranty claims. These earn full 10-point scores. Weak responses skip root cause analysis or don’t prevent problems from happening again. These suppliers just treat symptoms. They don’t fix real problems.

On-time delivery should hit 100% or higher. Top North American suppliers reach 100%+ delivery rates. They ship ahead of schedule to meet production needs. Suppliers dropping to 64-66% on-time delivery score just 23 points. That’s mediocre. Precision casting operations run tight production windows. Delivery failures create expensive delays.

ISO 9001 certification is the minimum for approved supplier lists. Premium suppliers hold IATF 16949 certification. That’s the automotive quality standard. Check that Quality System Score (QSS) ratings hit 960 or higher during first evaluations. Schedule on-site visits before placing production orders. Audit product processes in person. Check production capacity against your forecasted volume swings of ±20-30%.

Premium freight incidents reveal gaps in chain reliability. Zero incidents earn maximum scores. Five or more premium freight shipments per evaluation period score zero points. These emergency shipments cost 300-500% more than standard shipping. They point to poor planning or unreliable production schedules.

Build your decision matrix with these weighted factors: cost competitiveness (20%), quality performance (30%), chain risk (15%), innovation capability (15%), ESG compliance (10%), and digital integration (10%). Score each supplier 1-10 on each factor. Apply the weights. Add up the scores. The highest total wins. This holds true even if it’s not the lowest bid. A supplier scoring 8.7 weighted total beats a 7.2 scorer offering 15% lower unit prices. Quality failures and delivery disruptions wipe out those savings fast—usually within months.

Avoiding Common Supplier Selection Mistakes in Precision Casting

Most purchasing managers fail at supplier selection before they even request quotes. They skip the evaluation framework. This framework separates qualified suppliers from those who promise everything and deliver nothing. The precision casting market hits $23.6 billion by 2031—that’s a 4.0% CAGR from 2024’s $18 billion baseline. Growth creates supplier choices. More choices mean more mistakes if you lack screening criteria.

Production capacity checks come first. Ask suppliers for documented output numbers from the past 12 months. Request facility specs showing automated systems that keep quality high at large volumes. The global die casting market jumps from $77.2 billion in 2023 to $97.2 billion by 2028. Your supplier must scale with this demand curve. Facilities stuck in manual processes can’t keep pace. They create bottlenecks for your growth.

Quality control data reveals real performance. ISO 9001 certification is entry-level. AS9100 matters for aerospace applications. Demand third-party audit reports showing defect rates below 100 PPM. Check non-destructive testing (NDT) capabilities on-site. Suppliers running X-ray inspection, ultrasonic testing, and dye penetrant testing catch defects before shipping. Those relying on visual checks ship problems to your door.

Track record verification stops surprises. Review completed projects that match your casting complexity and alloy types. Aerospace suppliers should show defense or nuclear sector experience. Ask about Design for Manufacturability (DFM) support. This optimizes your designs. It cuts tooling costs by 15-30%. Suppliers without DFM expertise cost you more through the production cycle.

Lead time analysis protects production schedules. Request historical on-time delivery data for the past six months. Calculate their average delay percentage. Anything above 5% late deliveries signals unreliable operations. Get quoted lead times broken down: tooling development, prototype runs, and full production batches. Demand proof of flexibility for volume swings of ±20-30%.

Cost evaluation must go beyond unit price. Build an Analytical Hierarchy Process (AHP) model. Weight quality, delivery, and price. Total cost includes raw materials, tooling amortization, labor rates, quality control expenses, and logistics. Suppliers offering the lowest prices often rank worst in quality metrics and service responsiveness. A 12% cheaper quote becomes 40% more expensive after accounting for defect rework and delayed shipments.

Your RFQ package determines quote accuracy. Include complete CAD models and 2D drawings with GD&T tolerances. Specify exact material grades—not generic categories. List required surface finishes with Ra values. Provide annual volume forecasts, minimum order quantities, and production ramp timelines. State mandatory quality standards: ISO certifications, NDT requirements, and inspection protocols. Incomplete RFQs generate incomplete quotes. These cause budget overruns later.

Geographic location affects lead times and costs. China dominates with advanced foundries, short production cycles, and established logistics networks. The APAC region holds over 45% of the global casting market share with a 5.1% CAGR through 2030. But location alone doesn’t guarantee capability. Run the same evaluation criteria regardless of supplier geography.

Run this self-audit before committing: Does this supplier have documented experience in your product category and target markets? Can they fulfill multiple requirements to reduce your vendor count? Do they match your priority hierarchy—quality over price over service? Do they hold all required certifications with current audit dates? Missing yes answers mean missing supplier qualifications. Keep searching.

Conclusion

Finding the best ceramic filter supplier for Canada’s precision casting goes beyond price. You need a partner who gets your specific metal challenges. The right supplier brings material expertise. They know whether you need Al2O3 for ferrous alloys or ZrO2 for reactive metals. They match pore specs to your process needs. Plus, their filters hold up under real casting conditions.

Your filtration system shapes casting quality. It affects scrap rates. It changes your bottom line. You might look at Canada-based suppliers like Smelko for local support. Or you could check North American premium options for advanced laminar flow tech. Balance technical performance against delivery reliability and total cost of ownership.

Here’s your action plan: Audit your current casting defect patterns first. Match those needs against the supplier evaluation framework outlined above. Request sample filters from 2-3 shortlisted suppliers. Run side-by-side trials with your specific alloys. The data won’t lie. Neither will your defect rates. Choosing the best ceramic filter supplier for Canada’s precision casting means more than buying filters. You’re investing in consistent quality. You’re gaining competitive advantage.