Finding reliable sources for porous alumina ceramic in China can feel tough. Thousands of manufacturers claim expertise. So how do you spot real producers versus trading companies?

You’re sourcing filtration parts, catalyst supports, or custom multi-bore designs. The stakes are high. Wrong specs mean failed applications. Unreliable suppliers bring quality issues that can derail your production timeline.

What is Porous Alumina Ceramic and Why China Dominates Production

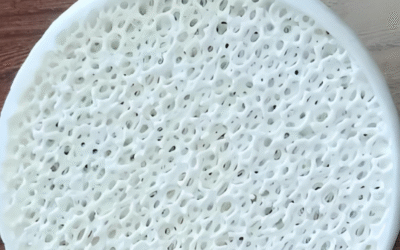

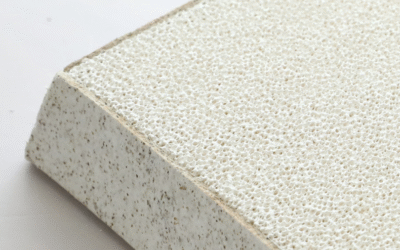

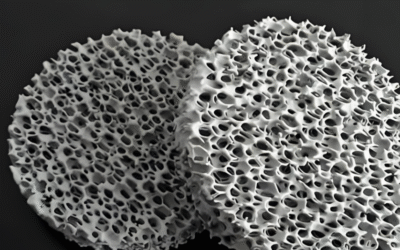

Porous alumina ceramic is made from alumina with controlled void spaces. These range from 1% to 40% porosity. You can get purity grades from 92% to 99.9% based on what you need. The pores connect throughout the material. This makes it lightweight yet tough. It handles extreme heat and harsh chemicals.

Key performance characteristics include:

-

High chemical resistance – resists acids, bases, and organic solvents without breaking down

-

Biocompatibility – safe for medical implants and tissue scaffolds

-

Thermal stability – works in temperatures from cryogenic levels to 1800°C

-

Customizable pore sizes – ranges from nanometers to millimeters for different filtration tasks

Industries use porous alumina in filtration systems, catalyst supports, sensors, medical implants, and emission controls. The automotive sector used the most in 2023. Stricter emission standards pushed demand for advanced particulate filters.

China’s Manufacturing Dominance Explained

Alumina ceramics took over 42.6% of the global porous ceramic market in 2023. The Asia Pacific region brought in 42.1% of total revenue that year. China led production volume.

China’s position comes from three key advantages:

Industrial scale and infrastructure – China built strong manufacturing capacity. This supports automotive, semiconductor, and pollution control sectors. High-purity alumina production happens in specialized zones. These zones have integrated supply chains.

Cost efficiency through volume – Sintering requires lots of energy. This drives up costs worldwide. Chinese makers offset these expenses through massive production scale. Smaller regional producers can’t match these price advantages.

Regulatory-driven demand – Strict pollution laws require advanced water and air filtration systems. Government programs support porous ceramic development for environmental needs. Pollution controls, automotive emission systems, and water treatment facilities drive domestic demand. This exceeds 40% of regional use.

The market keeps expanding. Forecasts show porous ceramic market growth from USD 6.90 billion in 2022 to USD 19.21 billion by 2031. That’s an 11.48% CAGR. China’s filtration segment leads revenue projections through 2032.

Top Verified Porous Alumina Ceramic Suppliers in China

China has over 2,026 verified porous alumina ceramic manufacturers on major B2B platforms. The country controls 55% of global high-purity alumina production and 56% of Asia-Pacific’s porous ceramic output. This creates opportunities and challenges for international buyers.

We found six manufacturers with solid track records in porous alumina ceramic production. They hold ISO 9001:2015 certification. They serve international markets in filtration, automotive, and electronics.

Leading Manufacturers and Their Specializations

Meetcera Ceramic (Fuzhou, Fujian) excels at ultra-high purity grades. They make alumina ceramics up to 99.9% purity using advanced sintering. Their zinc-toughened alumina (ZTA) composites work in demanding electronics and automotive uses. You get precision machining for tight tolerances on custom specs.

Dayoo Advanced Ceramic Co., Ltd. makes mid-range purity products with 92-95% alumina content. They use isostatic pressing methods. This creates uniform pore distribution. Products include porous tubes and balls rated for maximum operating temperatures between 1600-1800°C. Material hardness hits 9 on the Mohs scale. The elastic modulus reaches 380 GPa. Their ceramics suit high-stress filtration jobs.

CELESTEP offers competitive bulk pricing. They focus on alumina-based porous ceramics for large orders. Their factory direct model cuts out trading company markups. Those markups usually add 15-25% to final costs.

Innovacera uses China operations to serve the global filtration market. They’re a key player in the 42.6% alumina-dominated porous ceramic segment recorded in 2023. Their product line spans standard filtration parts to custom catalyst supports.

Lianyungang Henka Ceramics Technology Co. Ltd. shows up in multiple global supplier directories for specialized porous alumina parts. They make complex shapes. This includes multi-bore designs and custom end-sealing setups.

Dehuao Ceramics makes high-purity alumina porous products. They focus on consistent quality across production batches. Their processes keep strict purity controls during sintering cycles.

Technical Capabilities Comparison

All six suppliers work in the 92-99.9% alumina content range. They create porosity through reticulated structures and fine-grain webs. Methods include lost foam or isostatic pressing.

Electrical performance specs across these makers include resistivity of 10^14-10^16 Ω·cm and breakdown strength ≥150 kV/cm. These properties matter for sensor uses and electrical insulation.

Thermal properties show melting points between 2040-2715°C. Standard operating maximums stay at 1600-1800°C for long-term stability.

Customization options include hole diameter changes, porous design patterns, and shapes from tubes to balls to pipes. Precision tolerances reach ±0.001 mm for critical dimensions. Double-end structures and specialized sealing setups are available on request.

Most suppliers need bulk wholesale minimums. Exact order quantities vary. Raw alumina pricing averaged $529 per metric ton in September 2024, up 6.3% month-over-month. This affects baseline costs. Large producers absorb price swings better than smaller operations.

Regional Manufacturing Hubs: Where to Find Quality Producers

China’s porous alumina ceramic production sits in four main manufacturing zones. Each region built unique technical skills based on local infrastructure and export access.

Jiangsu Yixing: Precision Manufacturing Center

Yixing is the precision hub for high-purity alumina ceramics. Manufacturers here hit 95-99% alumina purity grades with top-tier dimensional accuracy. Precision machining reaches ±0.01mm tolerance control. So Yixing producers are the top pick for aerospace parts and semiconductor equipment.

The region makes 5,000 tons per year of high-purity porous alumina. Exports take up 60% of total output. Quality control systems meet strict international standards for critical uses.

Henan Dengfeng: High-Temperature Composite Specialist

Dengfeng leads in carbon fiber-reinforced silicon carbide (CVSiC) composite materials for porous alumina uses. Local makers excel at ceramics that handle temperatures up to 1700°C. These materials have thermal shock resistance 3 times higher than standard grades.

Technical specs include material density of 2.65 g/cm³ and strong structural integrity. Production capacity hits 2,000 tons per year. Military-grade furnace linings and high-heat industrial uses drive demand. Manufacturing costs run 20% lower than similar Western facilities.

Fujian Xiamen: Export Gateway for Advanced Materials

Xiamen serves as China’s main maritime hub for porous ceramic exports. The region controls 80% of global porous alumina powder and crystal shipments. Manufacturers focus on nano-scale alumina particles with 50-100nm grain sizes and 99.999% purity levels.

The cluster has over 150 companies making 3,000 tons per year. Focus areas include 5G communication parts and power device uses. Port access cuts international shipping times by 15-20% versus inland facilities.

Jiangsu Lianyungang: Large-Scale Component Manufacturing

Lianyungang pairs port access with integrated chemical processing infrastructure. The region makes 4,000 tons per year of porous alumina ceramic products. Manufacturing handles large-format parts exceeding 500mm diameter. Corrosion resistance covers the full pH 1-14 range.

The industrial cluster has 200+ certified suppliers. Precision mold processing hits 95% automation levels. This setup gives you competitive edge for bulk orders needing consistent quality across large runs.

How to Select Your Regional Source

Match your technical needs to regional strengths. Need ultra-precise dimensions for electronics? Go with Yixing manufacturers. Need extreme temperature resistance? Dengfeng’s composite specialists have proven solutions. Planning large export volumes? Xiamen and Lianyungang give you logistics cost savings of 15% or more.

Check supplier credentials through ISO 9001 or AS9100 certifications. Ask for purity test reports showing >98% alumina content. Look for production capacity use above 80% and delivery times under 30 days for in-stock specs.

Key Technical Specs to Check Before You Buy

Buy porous alumina ceramic without checking specs? You risk expensive failures. A 2024 survey found 32% of first-time importers got materials that failed their tests. Why? They skipped technical checks before ordering.

Core Material Parameters to Confirm

Alumina purity level tops your check list. Get written proof of 92%, 95%, 99%, or 99.9% alumina content for your needs. Ask for third-party lab certificates with real composition data. Trading companies say “high purity” without proof. A German filtration company got 92% purity material. Their process needed 99%. The batch failed in 48 hours.

Porosity specs need exact numbers. Skip vague terms like “medium porosity.” State exact percentages: 15%, 30%, or 40% open porosity. Check pore size through ASTM E29 test data. Your order should list 50-micron, 100-micron, or 500-micron average pore diameter. Get measurement reports that match your tolerance needs.

Size accuracy stops installation problems. List exact measurements in millimeters with tolerances. A ±0.01mm tolerance costs more than ±0.1mm. Critical uses need it. State outer diameter, inner diameter, wall thickness, and length. Add straightness needs for tubes. Add flatness specs for plates.

Temperature and Strength Standards

Operating temperature range affects how long the material lasts. Check the supplier guarantees performance at your temperature. Standard grades work up to 1600°C. Premium types reach 1800°C. Get thermal shock data. How many cycles between room temperature and max temperature before it fails?

Strength metrics cover compressive strength in MPa. Also flexural strength for load-bearing uses. Hardness should reference Mohs scale (9 for alumina) or Vickers numbers. Get elastic modulus values for vibration or dynamic loads.

Industry-Specific Needs

Filtration uses need specific parameters. Set max water pressure in bar or PSI. List chemical resistance needs. Will the ceramic touch acids, bases, or solvents? State pH range from pH 1 to pH 14 if needed. Add flow rate needs and particle retention specs.

Catalyst support needs surface area in m²/g. Check pore volume in cm³/g. Can the material handle fast heating and cooling without breaking down? Get data on chemical stability with your catalyst types.

Electrical insulation needs breakdown voltage in kV/cm. Check dielectric constant and volume resistivity in Ω·cm. Electronics need 10^14 to 10^16 Ω·cm resistivity for solid performance.

Pre-Buy Steps That Stop Problems

Sample testing before bulk orders saves money. Order 5-10 pieces for your own tests. Run them through your real conditions. Check performance against your needs. A Taiwan semiconductor maker saved $45,000 by finding size problems during sample tests.

Factory audits check manufacturing ability. Look at equipment maintenance records. Check quality control steps. Look at incoming material storage. Humidity and temperature affect raw material performance. Check calibration certificates for production measuring tools.

Vendor history check shows reliability. Get customer reference lists from similar fields. Check how long they’ve made porous alumina. 25+ years means stable processes. Look at their safety records and industry awards like the Michael J. Casbon Safety Award.

Incoming Inspection for Your Team

Count first. Match pieces to purchase order numbers. Check for accessories, spare parts, and papers. Record supplier details, PO number, and delivery date.

Visual checks find obvious flaws. Look at size, shape, surface finish, and marks. Spot cracks, chips, or color changes. Check packaging. Shipping damage often shows poor handling at the source.

Tag parts to organize quality choices. Mark pieces as Accepted (meets all needs), Conditionally Accepted (minor issues needing supplier notice), or Rejected (major flaws needing reports). Take photos of flaws for records.

Measurement checks confirm specs. Use calibrated tools to check key sizes. Test a sample if ordering hundreds. Compare results to supplier certificates. Differences over ±5% need investigation.

Guarantee Terms for Protection

Performance warranty should cover 12-24 months from delivery. List what triggers claims: size variance, early failure, or contamination. Check the supplier covers full costs: parts, labor, and return shipping.

Max repair time stops production delays. Get written promise for replacement within 15 business days for bad materials. International shipping adds steps. Ask if the supplier keeps stock in your region.

Brand verification applies for proprietary formulas. Get written proof of licensing, patent rights, or authorized reseller status. Generic swaps void warranties and may fail your needs.

Your technical spec checklist drives sourcing success. Skip even one parameter and you create risk. The 15-20 minutes spent listing needs saves weeks fixing failed parts.

Direct Factory Purchase vs. B2B Platform Sourcing

You need porous alumina ceramic suppliers in China. Two paths exist: B2B platforms like Alibaba and direct factory partnerships. Each route has different benefits. Each affects your buying results.

B2B Platform Sourcing: Speed and Transparency

B2B platforms group 20% of indirect spend across 80% of vendors in one place. This cuts rogue spending. You get instant price comparisons. 64% of buyers expect real-time pricing data—platforms provide this.

You find a wide supplier pool. Credentials are prescreened. Dynamic pricing matches the scale benefits of traditional spot purchases. Companies placing over 100 daily orders get streamlined workflows. 93% of these orders are repeat purchases. This creates efficient automation chances.

Integrated logistics reduce delivery times and costs. Payment options include net terms. These appear in over 60% of mid-sized marketplace transactions. But 40% of buyers face frustrations. Payment flexibility is limited.

Platform stats reveal challenges too. 77% of buyers hesitate due to order errors. 97% cite errors as barriers. 77% experience frequent mistakes. These problems push 71% of buyers to switch suppliers. They want better experiences.

Direct Factory Purchase: Customization and Control

Direct factory relationships shine in three areas. First, customization flexibility. Second, dedicated technical support. Third, negotiated bulk discounts. You skip the 25% of B2B webstores rated as hard to use. You avoid the 40% stock availability and payment issues common on platforms.

Manual bidding and tendering work well for bulk orders. These need specific changes. Factory engineers handle your porosity needs. They adjust pore sizes. They create custom dimensions. This personal approach helps. Standard catalog items don’t always fit your needs.

50% of buyers prefer manufacturer marketplaces over general B2B platforms for strategic purchases. Factory audits show production capabilities. You verify these on-site before large orders. Sample testing comes with direct technical support. Engineers understand your use case.

Payment security gets better through letters of credit. You avoid platform middlemen. 73% of buyers prefer online purchasing. Yet direct factory relationships provide stability. Platforms can’t match this.

Price Range and Cost Factors (2025 Market Data)

Porous alumina ceramic pricing in China covers a wide spectrum in 2025. Standard industrial-grade materials with 92-95% alumina purity range from $8-$15 per kilogram for bulk orders above 1,000 kg. Mid-range grades offering 95-99% purity cost between $18-$35 per kilogram. Ultra-high purity ceramics reaching 99.9% alumina content command premium prices of $45-$80 per kilogram. Customization complexity affects the final price.

Primary Cost Drivers in 2025

Raw alumina pricing sets the baseline. September 2024 saw prices hit $529 per metric ton, up 6.3% month-over-month. This upward trend continues into 2025. Global demand for high-purity alumina is rising. Semiconductor and renewable energy sectors drive this growth.

Energy-intensive sintering processes consume major costs. Chinese manufacturers have an edge here. They benefit from government-subsidized industrial electricity rates—about 30% lower than European competitors. This creates 15-20% lower production costs for energy-heavy operations like high-temperature firing cycles.

Order volume affects pricing. Minimum orders below 500 kg carry 25-40% price premiums over bulk purchases. Orders exceeding 5,000 kg unlock volume discounts of 12-18%. Custom specifications add $3-$8 per kilogram. Non-standard pore sizes, special geometries, or precision machining all increase the cost.

Hidden Costs Beyond Unit Price

International shipping from major ports like Xiamen or Lianyungang adds $0.80-$1.50 per kilogram to North American destinations. European shipments run lower at $0.60-$1.20 per kilogram. Express air freight multiplies these costs by 4-6 times.

Quality certification impacts total investment. ISO-certified materials meeting ASTM or GB standards include testing costs of $200-$500 per batch in the quoted price. Third-party verification for aerospace or medical applications adds another $800-$1,500. Certification body requirements determine the exact amount.

Payment terms influence real costs. Letters of credit add 1.5-2.5% in bank fees. Platform escrow services charge 2-4% transaction fees. Direct factory wire transfers avoid these charges. But you need established trust relationships.

Smart buyers calculate total landed cost per kilogram. This includes all fees, shipping, and potential quality failure risks. Don’t focus on FOB pricing alone.

Logistics and Import Considerations for International Buyers

Ocean freight from China to North America sees container volumes dropping through 2026. US imports hit 2.07M TEU in October 2025, down 7.9% year-over-year. The forecast gets worse: 1.79M TEU in March 2026 – that’s a 16.8% drop. Your porous alumina ceramic shipments face tough competition for space. Trade patterns are shifting fast.

Freight Mode Selection and Current Rates

Ocean shipping stays cheap for bulk orders over 500kg. China-to-US routes show weak demand. You can negotiate better container rates right now.

European routes work differently. China-North Europe rates jumped 10% in Week 50, 2025 to $276 per 40-foot container. China-Mediterranean routes shot up 19% to $874 per container. Book your European routes now. Lock in pricing before rates climb higher.

Air cargo costs 4-6 times more. But it cuts transit time from 25-35 days down to 5-7 days. November 2025 data shows air cargo from China to US fell 5%. Southeast Asian origins boomed. Taiwan air shipments rose 40%. Vietnam jumped 52%. Thailand climbed 37%.

Does your supplier operate in these regions? Air freight makes more sense as capacity grows.

Tariff Strategy and Compliance Updates

2026 brings tougher customs rules. The World Customs Organization requires digital documentation and interoperability standards. ESG traceability spreads across more supply chains.

Your porous alumina ceramic imports need detailed certificates. Get material composition documents. Keep origin documentation ready.

De minimis exemption removals push low-value shipments away from China. Product-specific surcharges now hit Southeast Asian imports. This happens despite their volume growth.

Request HS code classification from suppliers before you order. Alumina ceramics usually fall under 6909.19 (ceramic wares for laboratory/technical uses). Check this matches your product specs. Avoid reclassification penalties.

Conclusion

Finding the right supplier for porous alumina ceramic in China is simpler than you think. You have a clear roadmap now. Focus on proven manufacturing hubs like Zibo and Jingdezhen. Use verified B2B platforms. Talk directly with factories. Never skip technical specs and third-party certifications.

China’s porous alumina ceramic market gives you unmatched production capacity. Prices stay competitive. Customization options keep getting better. Need standard filtration parts? Looking for complex multi-bore designs? Either way, vet suppliers carefully. Get clear technical docs. Build relationships that last, not just chase the cheapest price.

What’s your next step? Pick 3-5 suppliers from different platforms. Ask for detailed technical data sheets with your exact requirements. Start with small trial orders. Test before you commit to bulk purchases.

Here’s the truth: the best porous alumina ceramic supplier in China isn’t always the biggest one. Look for the supplier whose capabilities match your needs. Their quality standards should meet your bar. Communication style matters too.

The Chinese ceramic industry is ready for you. Pick your partners carefully. Negotiate with confidence. Build relationships that mean more than just one-time deals.