Split-second decisions at the furnace can make or break your product quality. Pick the wrong foam filter sheet supplier? You’ll find defects after spending thousands on production costs.

The foam filter market is wide. Specialized manufacturers offer advanced ceramic foam technology. Established distributors bring decades of metallurgical expertise. But here’s the problem: finding suppliers who understand your specific alloy needs is tough.

You might source alumina filters for aluminum foundries in Michigan. Or you need silicon carbide options shipped from Guangdong to anywhere in the world. This supplier analysis cuts through the marketing noise.

You’ll discover where serious casting operations source their filtration systems. We show you what technical specs separate premium products from basic offerings. Plus, you’ll learn which partnership factors drive long-term casting success—beyond just comparing prices.

Understanding Foam Filter Sheets: Types and Material Compatibility

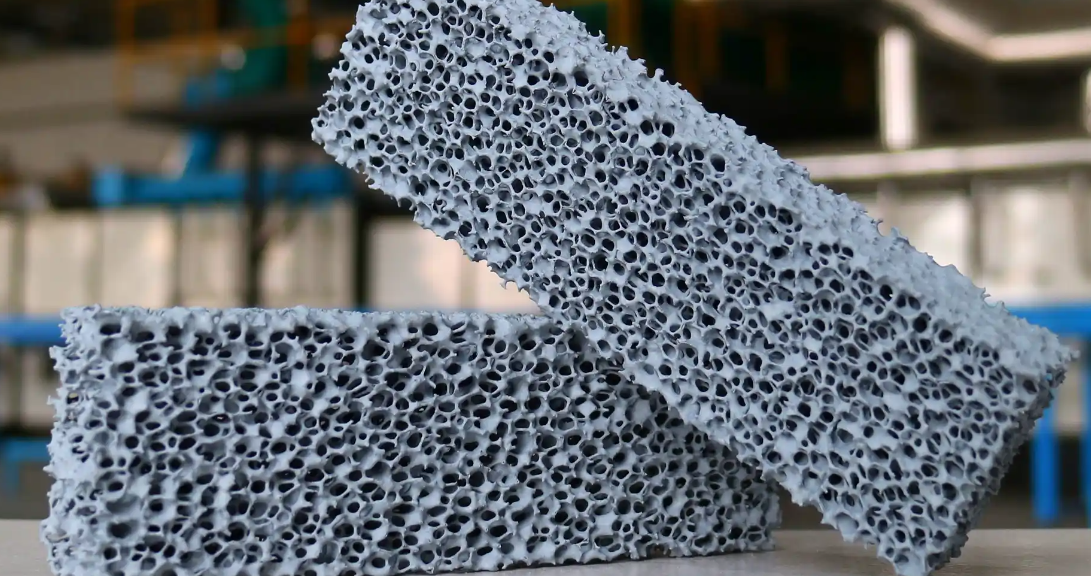

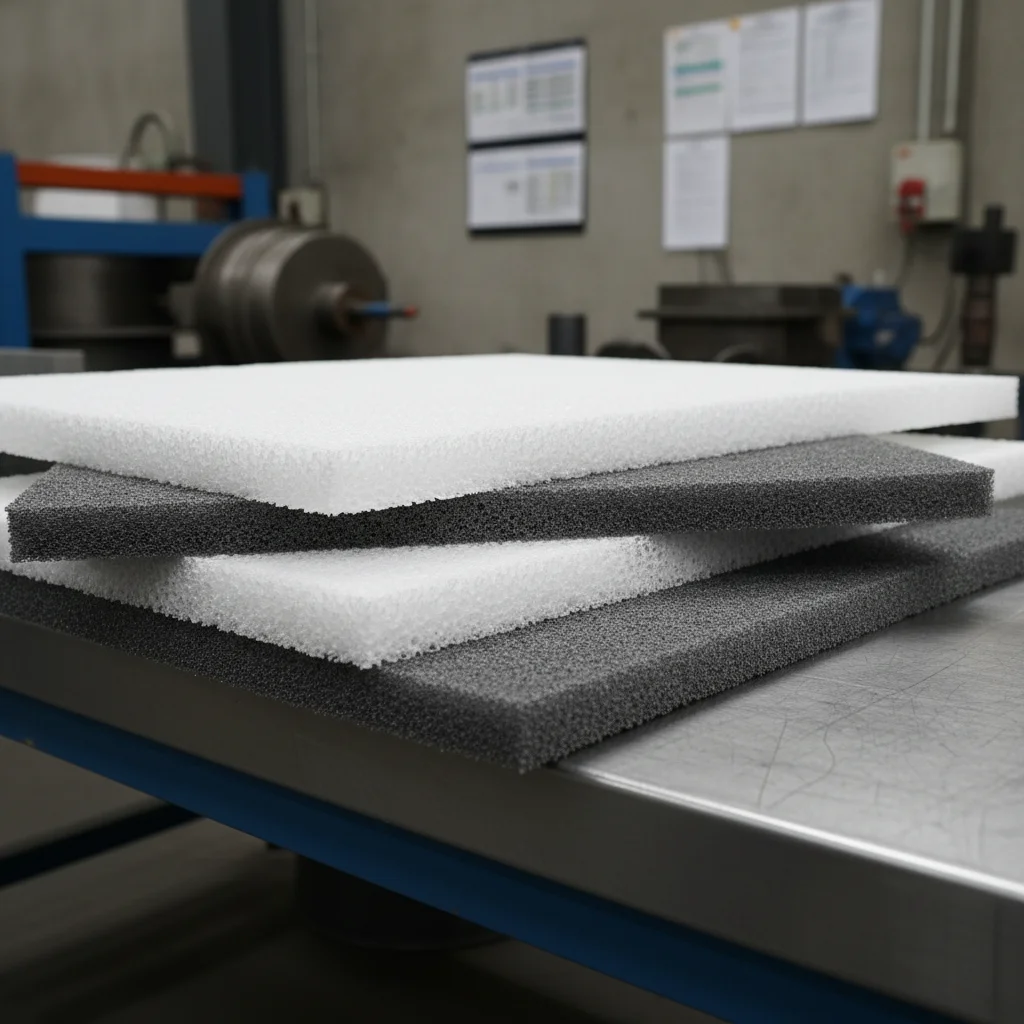

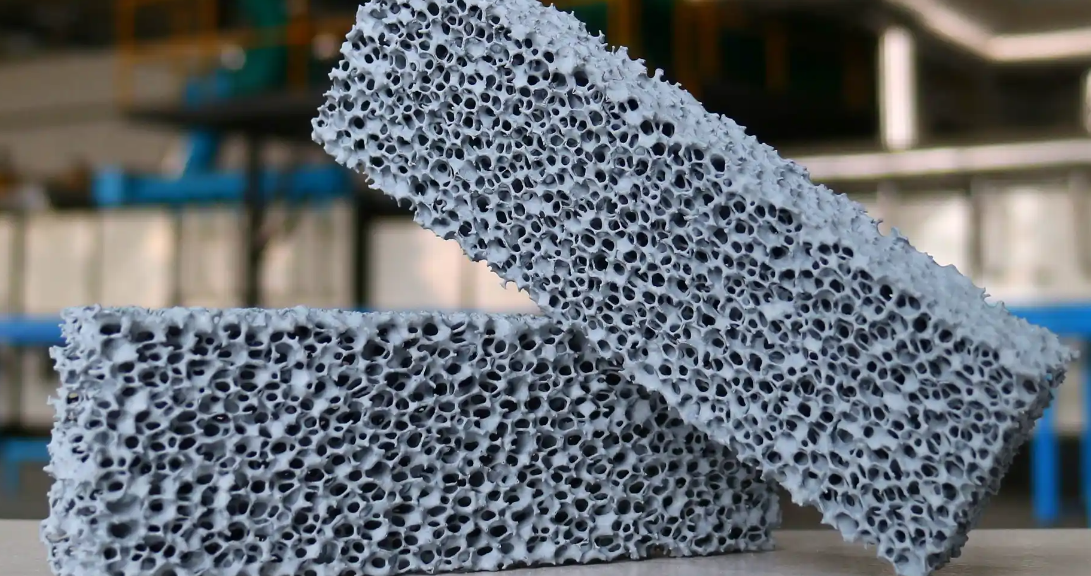

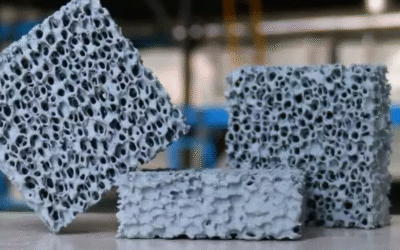

Foam filter sheets come in different types. Each type serves specific needs. The cellular structure controls how molten metal flows through. It also determines which impurities get trapped.

Core Material Categories

Reticulated flexible Polyester polyurethane is the top choice for metal casting. These sheets have open-cell skeletal strands with 97% void volume. This huge empty space lets metal pass through. At the same time, it captures slag and oxides.

Polyether polyurethane works best with water-based solutions. It attracts water and resists mildew. Polyester polyurethane handles gases like O2, N2, and CO2. Plus, it resists harsh chemicals and oils. The water-repelling nature makes it great for oil-resistant applications.

PPI Specifications and Thickness Requirements

Pores per inch (PPI) ranges from 3 to 110 across standard grades. Common specifications include 10, 20, 30, 40-50, 45, 60, 80, 90, and 100 ppi options.

Thickness matters more as PPI increases:

– 45 ppi requires minimum 1/8″ thickness

– 60 ppi needs 3/16″

– 80 ppi demands 7/32″

– 100 ppi works best at 1/4″ to 1/2″

Top USA Suppliers of Foam Filter Sheets

American foundries work with a core group of specialized manufacturers. These companies have built strong reputations over decades. They don’t just sell foam sheets. They create complete filtration solutions for critical casting operations.

Heritage Manufacturers with Deep Technical Know-How

All Foam Products Co., Inc. offers custom fabrication. They cut sheets from 1/4 inch to 16 inches thick using CNC precision. Their reticulated filter foams work in aircraft, automotive, and medical industries. GSA approval shows government contracts trust their quality. Every product ships Made in USA.

U.S. Rubber Supply Co. has operated since 1948. They focus on fire retardant filter foams with UL94 HF-1 listing. You get porosity options from 10 to 90 PPI. Both polyether and polyester types are available. Color choices include charcoal, white, and custom specs. Annual revenue hits $5-9.9 million. This proves sustained market demand.

American Excelsior Company brings massive scale. They’ve earned $50-99.9 million in revenue since their 1888 founding. They process polyurethane, polyester, polyether, polystyrene, and EVA materials. Their fabrication services include molding, slitting, and laminating. Plus, they offer three cutting methods: die cutting, waterjet, and kiss cutting.

Specialized Applications Experts

Klinger IGI Inc. targets gasket and seal applications. ITAR registration qualifies them for defense contracts. Their closed-cell options include polyethylene, PVC, silicone, and urethane.

Amcon Foam brings 40+ years of experience. They operate two US manufacturing facilities. Custom shapes with multiple porosities are their specialty. These work for air filtration, Liquid filtration, HVAC systems, and HEPA applications.

New England Foam stocks complete buns and sheets in reticulated formats. Porosity ranges from 10-90 PPI. Their charcoal and white options include UL compliant types. These suit fire-sensitive installations.

Top Chinese Makers Ship Foam Filters Worldwide

China builds more than half the world’s ships. This means steady access to foam filter sheets for Metal casting plants everywhere.

Shipping Networks Connect to Every Foundry

COSCO SHIPPING Lines handles your foam filter orders. They reach 650 ports across 150 regions. Their fleet has 550+ container ships with 3.4 million TEUs capacity. That’s 10.5% of the global market. In 2024 alone, they moved 18.3 million TEUs. Revenue hit USD 220 million.

Transpacific routes move filters from Guangdong to California in 14-18 days. Intra-Asia shipping links Southeast Asian foundries in 3-7 days. Asia-Europe routes reach German and Italian casting plants in 28-35 days.

China Merchants Port handled 145.75 million TEUs in 2024. That’s 6% more than the year before. Their network covers Shantou, Qingdao, Xiamen, Shenzhen, and Zhanjiang in China. Overseas terminals operate in Brazil, Sri Lanka, and Togo. These expand reach to new markets.

Specialized Suppliers for Aluminum Casting

Aluminum casting suppliers fall into two groups. Big names like Alcoa Corporation and Rio Tinto lead with huge production power and worldwide reach. Smaller shops like Apex Aluminum die casting Co. Inc. and Gulan Die Casting Ltd create custom parts for specific uses.

The global aluminum casting market reached USD 95.67 billion in 2025. By 2032, it will climb to USD 162.39 billion. That’s a 7.8% CAGR. Pressure die casting takes 54.4% of this market through 2035. Transportation uses most of this metal. Cars and trucks drive the biggest demand and sales.

Major Players Setting Industry Standards

Ryobi Limited makes light, strong parts for car and plane makers. They cast electrical parts and engine blocks. Alcoa Corporation works with top-grade aluminum mixes. Their green Casting methods helped them grow in aerospace and auto markets.

Nemak works only in car aluminum Die casting. Millions of vehicles run with their engine blocks and transmission cases. Fuchs Metallbau GmbH tops European markets. They make parts for factories and electrical gear across Europe, North America, and Asia-Pacific.

GF Casting Solutions leads pressure die casting. Foundries buy from them for reliable quality at big volumes. Magna International Inc. blends casting into full car systems. This setup saves money for car makers.

Regional Manufacturing Powerhouses

Asia-Pacific expands faster than other areas. China, India, and Japan run major casting plants. Fast factory growth boosts demand. Car plants keep growing. Aluminum Corporation of China Limited runs huge sites in Guangdong and Shandong provinces.

United Company RUSAL sends aluminum from Russian plants to foundries worldwide. North American makers like Aluminum Die Casting Company, Inc. and Consolidated Metco, Inc. work with stable markets. The US market hit USD 13,085.6 million in 2024. It will reach USD 17,914.3 million by 2030.

European makers like Dynacast Deutschland GmbH and Buvo Castings BV keep loyal customers. Germany’s exact engineering ways back up top casting quality.

Specialized Service Providers

Alcast Technologies, Ltd. works with tricky shapes for plane parts. Beyonics Pte Ltd makes cases for electrical and tech products. Shiloh Industries Ltd. builds lighter car frame parts. Bocar Group makes engine and transmission pieces.

These makers stand out through fresh ideas and custom work. They put money into Industry 4.0 tech. Smart factory tools boost speed in pressure die casting work. New products and smart buyouts add to what they can do.

Power bills and metal price shifts cut into profits. Rules about pollution push for better methods. Still, military spending on light weapons brings new sales. Factory growth in developing countries keeps demand strong.

Critical Selection Criteria: Technical Specifications

Buyers who focus on price per square foot make a costly mistake. The real cost hits months later. Defective castings pile up. Filters clog mid-pour.

Technical specs separate the real metallurgy experts from basic foam sellers. Set clear performance targets. These targets impact your casting quality and efficiency.

Performance Benchmarks That Matter

Set exact filtration efficiency thresholds before you request quotes. A 95% particle capture rate sounds good. But competitors offer 98.5% for aluminum oxide removal at 1400°F.

Tie your PPI requirements to your alloy composition. Aluminum foundries running A356 alloy need 20-30 PPI for best flow rates. Zinc die casters need 40-50 PPI to filter smaller particles. Write down these numbers in your technical spec. Vague requests like “high filtration” or “good flow characteristics” confuse suppliers. You’ll get inconsistent products.

Set thermal stability ranges with hard limits. Standard Polyurethane foam filters collapse above 450°F. Ceramic foam variants hold up to 2200°F. Your spec must state maximum operating temperature. Add peak exposure duration. List acceptable thermal cycling patterns. Include failure mode specs too—how the filter should break down past its limits.

Material Compatibility Requirements

Match foam chemistry to your metal system. Polyether bases resist water-based fluxes. But they break down with hydrocarbon exposure. Polyester formulations handle petroleum-based release agents. Yet they fail in high-humidity settings.

Write down chemical resistance requirements with actual exposure conditions. List every flux, degasser, grain refiner, and cleaning agent that touches your filters. Add concentration percentages. Note contact duration. Get independent lab certification showing compatibility test results. Third-party validation removes supplier guesswork.

Set compression set recovery rates for reusable filters. Premium sheets recover 90% of original thickness after 24-hour compression at 50% deflection. Budget options hit 70% recovery. This gap impacts filter lifespan and how often you replace them.

Quality Control and Testing Protocols

Get batch-specific test data with every shipment. Cell count uniformity across sheet dimensions stops preferential flow channeling. Measure PPI variance. Quality suppliers maintain ±2 PPI tolerance across entire sheet dimensions. Cheap options show ±8 PPI swings. These create inconsistent filtration zones.

Ask for pore size distribution curves, not just average PPI ratings. Two 30 PPI sheets can perform very differently. One might have tight distribution (25-35 PPI range). Another varies widely (15-50 PPI spread). The distribution curve shows filtration consistency.

Set acceptance criteria tied to measurable casting defects. Track inclusion counts per cubic inch in finished parts. Monitor surface finish ratings using standard roughness measurements. Link filter performance data with final product quality metrics. This creates objective supplier scorecards based on real production results, not theory.

Documentation and Traceability Standards

Demand complete material certifications with manufacturing lot traceability. Every sheet needs unique batch identification. This links to raw material sources, processing parameters, and quality inspection records. This paperwork becomes critical for troubleshooting unexpected casting defects.

Ask for detailed installation and handling specs. Filter placement angles matter. Sealing pressure requirements matter. Pre-pour conditioning steps affect performance as much as material properties. Suppliers who provide full operational guidance show deeper technical knowledge than those who ship product with basic instructions.

Cost Analysis: Price Ranges by Supplier Type

Foam filter sheet prices vary a lot based on who’s selling. A direct manufacturer might quote $2.50 per square foot. A regional distributor hits you with $4.80 for the same spec sheet. Know the supplier cost structures. This stops you from overpaying by 90% or more.

Raw Material Costs Drive Base Pricing

Raw materials eat up 40-60% of your total foam filter cost. Polyurethane chemical prices move with oil markets. Steel mold tooling costs shift with commodity indexes. Ceramic coating materials for high-temp filters jump as rare earth element prices spike.

Currency swings add another layer. Chinese manufacturers benefit as the yuan weakens against the dollar. European suppliers face pressure as the euro strengthens. Tariffs on imported chemicals can push raw material costs up 15-25% overnight for certain supplier types.

Labor and Overhead Split by Supplier Category

Direct labor takes 10-25% of final pricing. This percentage drops a lot with high-volume automated producers. A Michigan manufacturer running CNC foam cutting machines keeps labor at 8-12%. A small custom fabricator hand-cutting specialty shapes hits 22-28%.

Overhead costs range from 15-30%. Large-scale operations spread fixed facility costs across millions of square feet each year. Boutique suppliers with lower volumes carry heavier overhead burdens per unit. ISO certification, quality lab equipment, and R&D facilities push overhead higher for premium manufacturers.

Logistics Costs Vary by Distance and Volume

Transportation grabs 5-20% based on shipping origin and order size. Domestic suppliers within 500 miles of your foundry keep logistics at 5-8%. Importing from China to US foundries adds 12-18% for freight, customs, and warehousing.

Container shipping changes make international sourcing risky. Port congestion, fuel surcharges, and seasonal demand can double your logistics costs in bad quarters. Bulk orders of 1,000+ sheets qualify for better freight rates than spot buying 50 sheets per month.

Supplier Margin Targets Shape Final Quotes

Most foam filter suppliers target 5-20% profit margins. Commodity-focused distributors work thin margins at 5-10%. They make money on volume turnover. Specialized manufacturers with unique ceramic foam technology command 15-20% margins through technical know-how.

Start with a $50 base cost example. A supplier targeting 1% margin quotes $50.50. Another pushing for 20% margin hits you with $62.50. The equation reveals everything: Price = Cost / (1 – Margin %). Got a high quote? Reverse-engineer their margin assumption.

Calculate True Total Cost Beyond Purchase Price

Purchase price tells half the story. The Supplier Performance Index shows hidden costs from quality problems. Use this formula: SPI = (Purchase Price + Nonperformance Cost) / Purchase Price.

A base SPI of 1.0 means zero quality issues. Anything above 1.0 flags trouble. A $3.00 filter that causes $0.60 in rework from casting defects shows an SPI of 1.2. That “cheap” filter costs $3.60 after you factor in downtime, scrap metal, and inspection time.

Track these nonperformance costs:

– Rejected castings from filter breakthrough

– Production delays from early filter clogging

– Extra quality inspection labor

– Scrap metal disposal fees

– Emergency rush orders for replacement filters

Benchmark Against Should-Cost Models

Build reverse price analysis for major suppliers. Take their $20 unit quote. Industry data shows similar manufacturers run 10-15% combined profit and SG&A. That leaves $17-$18 for production costs.

Break down the remaining amount:

– Fixed costs contribution: $3-$5 per unit

– Variable production costs: $11-$13 per unit

– Check if their quote makes sense against public financial data

Pull balance sheets and income statements for traded foam manufacturers. Compare gross margin percentages. A private supplier quotes prices that suggest 35% margins while public competitors average 18%? You’ve found leverage for talks.

Long-term Partnership Considerations

Suppliers either grow with your foundry or become dead weight within 24 months. The numbers don’t lie: 70% of business partnerships collapse before hitting year two. Another 60-65% of strategic alliances fail. The culprits? Unrealistic promises, mismatched goals, and communication breakdowns that destroy trust.

Structured Agreements Beat Handshake Deals

Casual partnerships tank at 35-45% success rates. Structured arrangements with written terms, scheduled reviews, and mutual commitments hit 70-80% success. The gap comes down to accountability.

Check in with your foam filter supplier each week. This maintains 81% performance consistency at the 90-day mark. Switch to once a month? Performance drops to 52%. No structure at all? You’re looking at 19% reliability.

Track these partnership elements in writing:

-

Quality benchmarks: Defect rates per shipment, filtration efficiency test results, dimensional tolerance compliance

-

Delivery schedules: Lead times, buffer stock agreements, emergency order protocols

-

Cost adjustment triggers: Raw material price changes, currency fluctuations, volume discount thresholds

-

Technical support response times: Phone/email response windows, on-site troubleshooting availability

-

Product development collaboration: New alloy compatibility testing, custom PPI development timelines

Revenue Impact Justifies Partnership Investment

Mature supplier partnerships generate 28% of total company revenue on average. That’s double the 18% contribution from paid search advertising. Partner-attributed deals close 53% more often than solo negotiations. They finish 46% faster too.

Deal sizes grow 32% larger when suppliers participate in your customer relationships. A foam filter supplier who helps you solve an automotive client’s aluminum casting defects becomes part of your value offer. Your customer sees integrated expertise, not just product transactions.

Certification Programs Multiply Supplier Value

Partners who complete formal certification programs earn 6× more revenue than those who skip training. The ROI hits 372% over three years with a 7-month payback period.

Push your foam filter suppliers toward technical certifications that benefit your operation:

-

Metallurgical fundamentals: Understanding alloy chemistries, solidification patterns, defect formation mechanisms

-

Quality systems: ISO 9001 implementation, statistical process control, root cause analysis methods

-

Application engineering: Filter placement optimization, flow modeling, thermal management

Certified suppliers reduce your support requests by 16%. They cut customer acquisition costs by 15%. Product adoption jumps 38.3% when suppliers understand how to position foam filters within your complete casting process.

In-Person Events Lock in Long-term Commitment

Almost 90% of partners rank face-to-face events as very important for long-term strategy success. Plant tours, industry trade shows, and annual business reviews build relationship depth that email chains can’t match.

Schedule these touchpoints:

-

Every three months – business reviews: Performance metrics analysis, upcoming project pipeline review, technical issue resolution

-

Annual strategy sessions: Multi-year forecasting, joint innovation roadmaps, contract renewals

-

On-site audits: Facility inspections, process observations, quality system assessments

-

Industry event participation: Shared booth presence, co-hosted technical sessions, customer entertainment

Top-performing partnerships achieve Net Promoter Scores of 61. Average partnerships sit in the 30s. The difference shows in how suppliers handle problems. Elite partners fix issues before you notice them. Mediocre ones wait for your complaint calls.

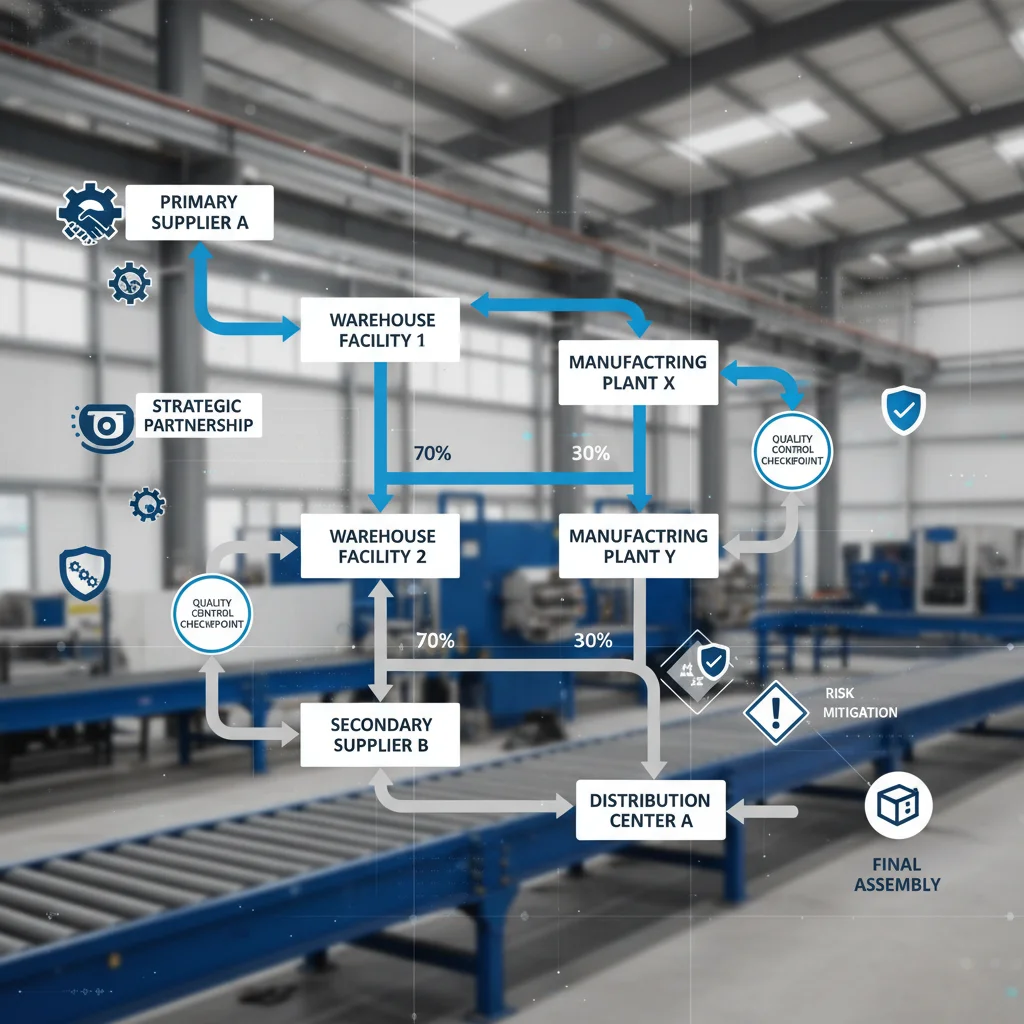

Build Multi-Supplier Redundancy for Critical Materials

Single-source dependency creates huge risk. One factory fire, one bankruptcy, one quality scandal—and your casting line stops cold.

Maintain two qualified foam filter suppliers for your primary alloy systems. Split volume 70/30 or 60/40. The secondary supplier stays engaged without taking most of your spend. They keep current certifications. They understand your specs. They’re ready to ramp if your primary source stumbles.

This redundancy costs 3-8% more than single-sourcing. It eliminates 100% supply chain failure risk.

Conclusion

Finding the best foam filter sheet for metal casting goes beyond price. You need to match technical specs to your casting needs. Plus, build relationships with suppliers who get your quality standards.

USA suppliers offer fast delivery and technical support. Chinese manufacturers provide better pricing on bulk orders. Your choice should balance three key factors: material compatibility with your alloy, certifications that meet industry standards, and supplier reliability for consistent quality.

Request technical data sheets and sample batches from 2-3 suppliers that fit your casting operation. Test these samples in real production before placing large orders. For aluminum casting, choose suppliers with proven expertise in this area. The filtration needs differ a lot from other metals.

Ready to source your foam filter sheets? Gather your technical specs. Reach out to suppliers from both markets. Let performance data—not marketing claims—guide your final choice. Your casting quality depends on it.