Ever wonder how foundries keep molten metal clean? Or how spacecraft survive re-entry heat? Ceramic foam does both—and a lot more. This porous, heat-resistant material powers everything from car exhaust systems to steel mill furnaces. Foundries alone ship over 42% of all units worldwide. They rely on its ability to trap impurities before they ruin a casting. Yet most people outside heavy industry have never heard of it.

Main Applications of Ceramic Foams

Ceramic foam plays vital roles in heavy industry, advanced manufacturing, and clean-tech sectors. It combines high porosity, heat stability, and strong structure. These traits make it essential where regular materials don’t work.

Molten Metal Filtration

Foundries are the biggest users. They account for 39.61% of total revenue in 2024 and hold 34.6% market share in 2023. Foundries ship 42.76% of all ceramic foam units around the world. They rely on these filters to cast iron, steel, aluminum, copper alloy, bronze, and brass parts.

The main benefit? Removing impurities. Ceramic foam traps oxide particles, sand bits, and slag. It catches them before molten metal reaches the mold. This filtering process improves surface finish. It also reduces internal defects and cuts down on scrap. High-volume auto casting plants see big gains. Even a 2% drop in scrap means millions saved each year.

Thermal and Acoustic Insulation

Construction, aerospace, and heavy manufacturing use ceramic foam panels for two-way insulation. The panels block heat transfer and absorb sound waves at the same time. The connected pore network breaks up acoustic energy. This makes the foam perfect for industrial noise barriers and aircraft engine covers.

Building retrofits aim for net-zero operating emissions. Ceramic foam insulation panels boost fire resistance without adding much weight. They don’t burn. They also conduct very little heat. These features help passive-house designs meet strict energy codes.

Automotive Exhaust Filtration

High-temperature exhaust needs materials that handle heat shock and oxidation. Ceramic foam filters do both jobs. They capture soot particles in diesel engines. They also support catalytic converters in exhaust treatment systems.

Electric vehicles haven’t reduced demand. Ceramic foam now has two roles in EV production. It filters aluminum during battery tray casting. It also forms thermal management pads that protect lithium-ion cells from dangerous heat spikes.

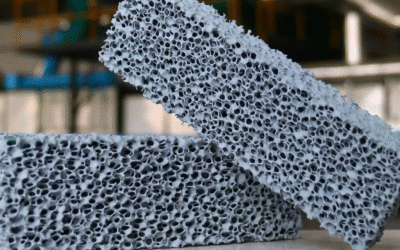

Furnace Lining

Electric-arc steel mini-mills put furnace linings through extreme heat cycles. The linings heat to 1,600°C, then cool fast, over and over. Traditional dense materials crack and break under this stress. Low-density spinel-calcium-aluminate foams (bulk density 2.8 g/cm³) flex a bit during heat expansion. This absorbs the shock. Service life extends from 18 heats to 31 heats per lining.

Makers now use up to 70% recycled ceramic waste in foam production. This slashes raw material costs. It also cuts the CO₂ footprint by 40% versus virgin batches. Total material use per ton of steel drops by about one-third.

Catalyst Support Structures

This segment is growing fastest, expanding at 8.09% CAGR through 2030. Hydrogen reformers, ammonia crackers, and auto catalytic converters now prefer ceramic foam over honeycomb substrates.

The edge comes from shape. High void volume (80–95%) paired with huge surface area creates strong turbulence and better mass transfer. Reactant gases touch catalyst coatings more fully. Engineers can cut precious-metal loading—platinum, palladium, rhodium—while keeping or boosting conversion rates. A single reformer unit saves $15,000–$50,000 in catalyst costs over its life.

Properties of Ceramic Foams

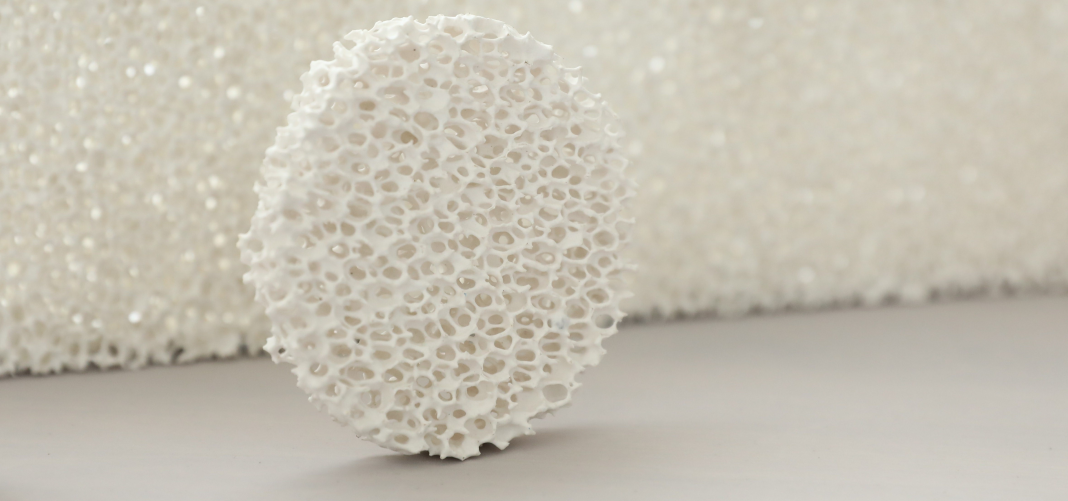

Ceramic foam works because it combines rare physical and heat traits. The open-cell design builds strength where you’d expect weakness. Each trait tackles a specific industrial problem.

Mechanical and Structural Characteristics

Compressive strength sits between 0.85 MPa and 8 MPa. That range sounds modest next to solid ceramics. But it works for filtering jobs. The foam keeps its shape under molten metal pressure. It doesn’t collapse. The linked pores create a rigid skeleton. This skeleton spreads the load across the whole structure.

Modern recipes add whisker reinforcement and oxide scales to advanced foams. These extras increase strength in tough conditions. The foam handles vibration, heat shock, and rough handling. No cracking.

Bulk density has dropped in recent heat-resistant designs. Lower weight means faster heat-up times. Installation gets easier too. Plus, it cuts shipping costs for big orders.

Thermal Performance of Ceramic Foam

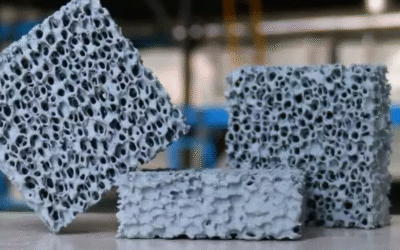

Silicon carbide foams stay stable above 1,500°C. Boride ceramic foams go higher. They fight off rust above 1,800°C with less than 5% weight loss after 1,000 heat cycles. This toughness counts in electric-arc furnaces and jet-engine test rooms. Materials that handle fast heating and cooling without breaking cut downtime. They also reduce swap-out costs.

Heat transfer changes based on what’s in the mix. Silicon carbide wins for better heat movement. Engineers choose it to move heat energy fast. Think cooling powerful electronics or balancing temperature in burn chambers.

Porosity and Surface Area

High empty space plus high surface area gives ceramic foam its filtering and reaction power. The web of linked pores stirs up flowing gases or liquids. This stirring pushes full contact with inner walls. Catalysts cover those walls. Reactions speed up. Filters catch more dirt per cubic centimeter than thick materials can.

Chemical and Acoustic Benefits

Ceramic foam fights off molten metal, acids, and bases. Silicon carbide grades do this best. It won’t melt or rust in harsh chemical flows. The same pore design that handles chemistry also soaks up sound waves. Building panels use this double benefit: fire protection plus strong sound blocking in one light material.

Manufacturing Methods

Producers build ceramic foam through a replica method that copies polymer sponge structure. The process turns soft plastic into hard, heat-resistant ceramic. The open-cell structure stays the same.

Material Selection

Engineers pick ceramic types based on end use. Silicon carbide (SiC) ceramic handles temperatures above 1,200°C. It fights off chemical attack too. Alumina (Al₂O₃) ceramic costs less. Use it for general high-temperature jobs. Zirconia (ZrO₂) ceramic stands up to thermal shock. Boride ceramics push the limits. They resist oxidation beyond 1,800°C. Magnesium-aluminate spinel and hybrid composites work for specialty roles. Single materials can’t handle these jobs.

Step-by-Step Production

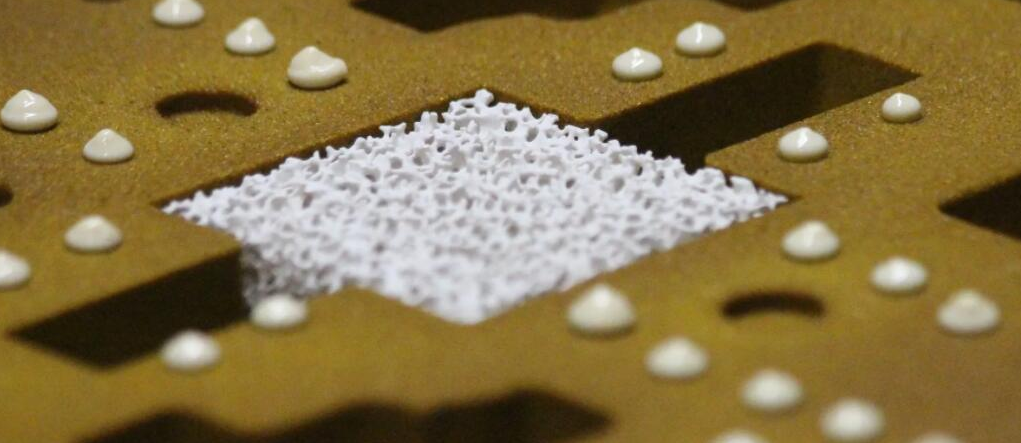

First comes ceramic slurry preparation. Powder mixes with binders and water. This forms a thick liquid. Workers pour this slurry over a polymer foam template. Polyurethane works best as the template. Gravity pulls slurry into every pore.

Impregnation comes next. Pressure or vacuum forces slurry deep into the template. Excess drains off. A thin coating remains on the polymer strands. Drying pulls out moisture. The piece goes into a furnace for pyrolysis at 1,000–1,200°C. Heat burns away the polymer. A hollow ceramic skeleton stays behind.

Sintering bonds ceramic particles into solid walls. Temperatures change by material. SiC needs 1,350–1,700°C. Alumina needs 1,500–1,800°C. Zirconia sinters at 1,400–1,500°C. Boride foams need up to 1,900°C. The furnace cools down over time. Workers cut and shape finished blocks.

Customization and Quality Control

Pore density ranges from 10 to 60 pores per inch (PPI). Change the template or adjust slurry thickness to shift this number. Porosity hits 80–95%. This matters for filtration and catalyst work. Bulk density falls between 0.2 and 0.8 g/cm³. Compressive strength spans 1–5 MPa. Reinforced versions go beyond 10 MPa.

Surface coatings add extra functions. Catalytic layers speed up reactions. Anti-oxidation films make the product last longer. Additive manufacturing now makes complex shapes. Templates can’t create these shapes. Boride prototypes survive 1,000 thermal cycles with less than 5% mass loss. This sets the standard for aerospace and nuclear markets. Products meet ASTM E265-15 for porosity and ISO 5017 for thermal properties.

Ceramic Foam Materials Used

Manufacturers pick ceramic foam materials based on three things: working temperature, chemical environment, and structural load. Each type has its own benefits. Your choice affects performance, cost, and how long it lasts.

Silicon Carbide (SiC)

Silicon carbide leads the market. It grabbed 45.18% market share in 2024. This material stays stable above 1,500°C. Molten aluminum can’t attack it. High heat transfer moves heat quickly. Foundries use SiC foams for aluminum casting filters. The material won’t dissolve. It won’t pollute the metal. Heat spreads through the filter structure. This stops hot spots that crack the material.

Alumina (Al₂O₃)

Alumina is the go-to standard option. It costs less than silicon carbide. Basic filtration jobs use alumina foams. The material handles moderate heat and chemical contact. It does the job for normal uses.

Magnesium-Aluminate Spinel

Steel mini-mills need recyclable protective linings. Low-density spinel-calcium-aluminate foams fill this role. Bulk density sits at 2.8 g/cm³. These foams boost service life by 72%—from 18 heats to 31 heats per lining. The savings come from shock resistance and reuse potential. Mills can turn used material into new linings.

Boride Ceramics

Second-generation boride foams—zirconium diboride (ZrB₂) and titanium diboride (TiB₂)—handle even higher heat. They resist wear above 1,800°C. Mass loss stays under 5% after 1,000 heat cycles. Aircraft flying at extreme speeds, aerospace heat shields, and nuclear systems need this strength. Regular ceramics break down fast in these tough spots.

Hybrid Composites and Recycled Content

Hybrid mixes combine whisker support and oxide layers. Engineers build these for tough multi-use jobs. Custom blends fix problems that single materials can’t.

Green practices count too. Makers now use up to 70% recycled ceramic waste in steel-making materials. This drops virgin material costs. It also cuts pollution without losing quality.

Industry and Market Sectors

The ceramic foam market hit $492.67 million in 2025. It’s heading toward $643.29 million by 2030. Growth holds steady at 5.48% CAGR. Industries need high-temperature filtration, energy savings, and emission control. This drives demand.

Regional Powerhouses and Revenue Distribution

Asia-Pacific controls 46.82% of global revenue in 2024. Connected chains, large casting operations, and rising EV production give this region an edge. China, India, and Southeast Asian countries invest billions in smart manufacturing. Energy-saving programs get huge funding. Government support for low-carbon steel and battery making pushes ceramic foam demand higher.

North America brought in $109.9 million in 2023. Metal casting, foundry work, and car exhaust filters drive this market. Net-zero energy rules in the U.S. and Canada boost ceramic foam use in building updates. New codes require fire-proof, light insulation that lowers emissions.

Fastest-Growing End-Use Sectors

Power generation and energy applications grow fastest at 8.01% CAGR. Hydrogen reformers, fuel-cell stacks, and solar plants need materials that handle extreme heat. They also support chemical reactions. Ceramic foam beats old honeycomb carriers. Better flow and transfer cut precious-metal use in catalysts. Costs drop. Efficiency stays high.

Construction still holds a big share. But energy-sector growth now beats both construction and automotive. Biomedical frames, electronics cooling, and flame control are new areas. These uses create revenue that didn’t exist five years back.

Material Shifts and Sustainability Trends

Silicon carbide takes 45.18% of material-type share. It stays stable above 1,500°C. Heat moves through it well. Advanced materials grow faster at 7.76% CAGR. Think magnesium-aluminate spinel, boride ceramics, and hybrid mixes. Aerospace and nuclear buyers pay top dollar for boride foams. These resist 1,800°C and last 1,000+ heat cycles.

Recycled content changes cost models. Steel mini-mills swap up to 70% virgin raw materials for recycled ceramic waste. Production costs fall. This meets pressure for circular practices across Asia-Pacific and Europe.

Numeric Specifications/Core Data

Market analysts track ceramic foam through different measurement methods. These methods show growth patterns and where the market concentrates. The global ceramic foam market reached USD 441.7 million in 2023. The market should climb to USD 492.67 million in 2025. By 2030, it will hit USD 643.29 million. Growth rates change based on research methods. Some studies show 5.2% CAGR from 2024 to 2032. Others report 6.37% CAGR between 2023 and 2028. Still others track 7.9% CAGR spanning 2022 to 2030.

Another valuation model puts the 2024 market at USD 4.23 billion. This model projects growth to USD 7.73 billion by 2030. This higher number includes broader industrial ceramic types beyond traditional open-cell foam products.

Molten metal filtration took 19.6% of market share in 2023. But it generated 39.61% of total revenue in 2024. This revenue gap shows premium pricing. High-performance filters in critical casting operations command higher prices.

North America brought in USD 109.9 million in 2023. That’s about one-quarter of global ceramic foam revenue. Regional data shows where manufacturing intensity meets environmental rules. This intersection drives adoption rates.

Temperature resistance sets material selection limits. Silicon carbide foams stay stable above 1,500°C. Advanced boride ceramics work past 1,800°C. They show mass loss under 5% after 1,000 thermal cycles. These specs decide which ceramic foam grades work for extreme environments. They also separate them from standard industrial uses.

Advantages

Ceramic foam brings real gains across industrial operations. The benefits fall into three groups: cost savings, technical performance, and meeting regulations. Each one solves a specific problem in modern manufacturing.

Filtration and Scrap Reduction

Molten metal filters cut foundry scrap. Plants using ceramic foam filtration see fewer defects. Surface finish gets better. Internal voids shrink. The result? Less rework and fewer rejected castings. High-volume facilities report scrap reductions that save hundreds of thousands of dollars each year. Every percentage point counts at thousands of tons per month.

Automotive exhaust systems see similar gains. Ceramic foam filters resist harsh chemicals and extreme heat better than metal mesh options. Emissions control works more reliably. Precious-metal catalyst coatings last longer. The substrate doesn’t break down.

Mass Transfer and Catalyst Efficiency

Foam substrates create turbulence that honeycomb structures can’t match. Gases mix completely. Contact with catalyst coatings goes up. Engineers get higher conversion rates using less platinum, palladium, and rhodium. The savings add up over equipment life. A single reformer unit can save $15,000–$50,000 in catalyst costs versus traditional designs.

Multi-Functional Building Material

Fire resistance, sound damping, and heat insulation—all in one lightweight panel. Construction teams skip separate layers for each function. Installation takes less time. Total wall thickness drops. Weight goes down, which helps retrofit projects on older structures. Building codes get stricter each year. Ceramic foam panels help hit net-zero targets without major structural changes.

Customization and Compliance

Manufacturers adjust pore size, density, and chemistry to match exact job needs. Custom specs solve problems that standard materials can’t. This flexibility helps companies meet stricter emissions rules across Europe, North America, and Asia-Pacific markets. Meeting regulations gets easier with material that adapts to new standards.

Summary List of Key Uses

Ceramic foam solves problems across dozens of major industries. The material offers high porosity, thermal stability, and chemical resistance. These strengths deliver real performance gains.

-

Molten metal filtration – Foundries filter copper alloys, cast iron, aluminum, steel, bronze, and brass. This removes unwanted particles, improves cast quality, and cuts scrap rates on production lines.

-

Catalyst support structures – Hydrogen reformers, ammonia crackers, and automotive exhaust systems use foam substrates. These beat honeycomb designs for mass transfer. Plus, they reduce precious-metal loading costs.

-

Automotive exhaust filters – Catalytic converters and diesel particulate filters use ceramic foam. This cuts emissions and boosts fuel efficiency even at extreme exhaust temperatures.

-

Thermal insulation – Building panels and spacecraft heat shields need foam’s ability to block heat transfer. It does this without adding weight or hurting fire safety.

-

Acoustic insulation – Residential and commercial construction projects use sound-dampening panels. These absorb noise through connected pore networks.

-

Furnace lining – Industrial, metallurgy, and glass furnaces use foam linings. They handle repeated heat cycles and last longer between repairs.

-

Aerospace components – Jet engines, hypersonic vehicles, and advanced propulsion systems use foam for heat shielding and thermal protection. These are critical zones.

-

Energy sector applications – Membrane reactors, solid-oxide fuel cells, solar plants, and heat exchangers use foam’s large surface area and thermal performance. This boosts efficiency.

-

Environmental protection – Air and water filtration systems, flame stabilization equipment, and waste treatment facilities use ceramic foam. It helps meet stricter regulatory standards.

-

Petrochemical and glass manufacturing – Operational filtration and high-temperature process components use foam’s chemical stability and structural strength.

-

EV thermal management – Battery packs and structural components use foam pads. These control heat and stop thermal runaway in lithium-ion cells.

-

Construction fire-resistant panels – Builders add foam into insulation systems. This combines fireproofing with energy efficiency in one layer.

-

Emerging niche markets – Electronics cooling substrates, industrial flame stabilizers, and new catalyst supports are fast-growing specialty areas. These didn’t exist ten years ago.