Looking for good suppliers to buy foam filters for aluminum casting in China? It feels like a maze. You face manufacturers, middlemen, and quality doubts at every turn.

Are you a foundry manager growing your production? Or a procurement specialist checking new vendors? The gap between a verified manufacturer and an unreliable trader is huge. One gives you smooth operations. The other brings production delays that cost real money.

This guide shows you five verified manufacturers with proven results. You get direct contact info, price ranges, and quality checks. We cover which suppliers focus on specific filter grades. MOQ requirements vary from 100 to 5,000 pieces – you’ll know how to handle them. Plus, you’ll see the key specs that split premium filters from poor ones.

You’ll also learn the insider tricks for sample testing and import logistics. These are the same methods experienced buyers use to cut risk when sourcing foam filters for aluminum casting in China.

How to Find Foam Filters for Aluminum Casting in China

Finding foam filters for aluminum casting from China? You need a clear evaluation system. This helps you spot reliable manufacturers and avoid risky ones. The buying process has five key stages. These stages follow proven supplier assessment methods.

Stage 1: Supplier Discovery – Start by building your vendor list. Use B2B platforms like Alibaba and Made-in-China. Check trade shows like Canton Fair and China Foundry Expo. Ask for industry referrals too. Mark each supplier type: factory direct, trading company, or agent.

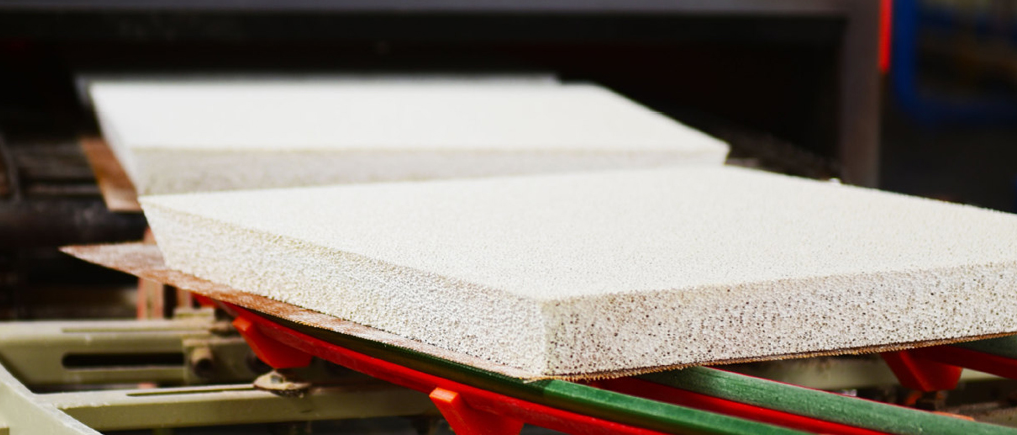

Stage 2: Capability Verification – Set up your assessment criteria. Check production capacity (units per month). Look for certifications like ISO 9001 and automotive OEM approvals. Review filter specs: pore sizes 10-60 PPI, thickness 20-75mm. Compare their claims with factory audit reports.

Stage 3: Quality Indexing – Give each foam filter supplier a qualification code. Base this on real evidence. Use Code “A” for factories with third-party test reports. These should show alumina content ≥90%. Code “B” goes to self-certified specs. Code “C” marks unverified claims.

Stage 4: Comparative Charting – Build a comparison chart. Group suppliers by MOQ levels: 100, 500, 1000, or 5000 pieces. List unit prices ($0.80-$3.50) and delivery times (7-30 days). Note their specialty. Some focus on high-purity filters. Others offer standard-grade options.

Stage 5: Decision Mapping – Look at cost versus quality. Compare this against your casting needs. Match filter pore density to your aluminum alloy (A356, ADC12). Consider your reject rate targets.

Top Verified Manufacturers of Aluminum Casting Foam Filters in China

China’s foam filter industry is based in three provinces: Hebei, Jiangxi, and Shandong. These areas have factories with strong export records and large production capacity. Here are five verified manufacturers you can contact.

FoundryMax (Foundry Max Filter) operates in Cangzhou City, Hebei Province. They hold three ISO certifications: 9001:2015, 45001:2018, and 14001:2015. Production hits 200,000 pieces per day. Annual output goes beyond 1 billion filters. They work with 1,200+ foundries in 35 countries. Their FM-09 SiC filters handle gravity, die, squeeze, and sand casting. The filters catch particles from 10 to 50 micrometers. Eight invention patents support their production methods.

Cangzhou Sefu Ceramic New Materials Co. Ltd. makes alumina ceramic foam filters. They focus on high-purity filtration. This cuts down casting defects. Their filters boost metal yield rates. You get detailed preheating instructions with each order.

AdTech Metallurgical Materials Co., Ltd. offers flexible ordering. MOQ starts at just 1 piece. Prices range from US$3-10 per filter. For 2026, aluminum foundry applications cost between US$0.10-5.00. They make ceramic foundry filters and metal foam filters for different casting methods.

DTYR Filters has over 20 years of manufacturing experience. They offer standard foam filters in multiple PPI grades (10-60 PPI). Their product line covers all common aluminum casting processes.

Made-in-China.com lists verified Diamond Member suppliers from Hebei and Jiangxi. One Hebei supplier sells alumina ceramic foam filter plates at US$8.906-28 per piece (MOQ 500 pieces). They have a 5.0 rating and deliver on time. Another Hebei maker offers 30-40 PPI filters for gravity sand casting at US$3-20 per piece (MOQ 50 pieces). A Jiangxi supplier has round or square 10-60 PPI filters starting from US$0.1 per piece. Minimum order is just 1 piece.

Prices change based on PPI density, filter size, and order volume. Filters with 30-40 PPI work for most aluminum alloy casting. Higher PPI ratings (50-60) fit premium uses that need ultra-clean metal.

Adtech (Cff Filter Factory)

Adtech’s CFF Filter Factory runs production lines for over 50 different specs. They make alumina ceramic foam filters that meet global foundry standards. Their factory has SGS verification and two ISO certifications: ISO9001 for quality and ISO14001 for the environment.

Standard Product Range

They stock eight common square sizes: 7×7, 9×9, 12×12, 15×15, 17×17, 20×20, 23×23, and 26×26 inches (all with ±3mm tolerance). Standard thickness is 50mm ±2mm. You can order 25mm or 75mm versions based on your metal flow needs. Each filter has a 17.5° bevel angle (±1.5° precision). This helps it sit secure in filter boxes.

Need custom shapes? We make rectangular, round, trapezoidal, and odd dimensions. Our tooling team handles special size requests for unique casting setups.

Packaging for Export

Take the 26-inch model as an example. Each carton holds 4 filters measuring 660x660x50mm. Eight cartons stack on one pallet. That’s 48 filters per pallet. Pallet size: 1100x1100x2200mm. Total shipping weight: 490 kg. This standard packing keeps filters safe during container shipping from Chinese ports.

Baoding Ningxin Group – Largest Molten Metal Filter Producer

Baoding Ningxin Group is one of China’s largest molten metal filter makers. They’ve been in business for over 20 years. The company started in 2002. They operate through two legal entities: Baoding Ningxin Group Co., Ltd. and Baoding Ningxin New Material Co., Ltd. Their plants are in Baqie Industrial Zone, Tang County, Baoding, Hebei Province.

Production Scale and Infrastructure

They run two plants. They cover more than 30,000 square meters. Their team has over 200 people. They handle making products, checking quality, and shipping overseas. This gives them strong production power. Each month They make 10 million fiberglass mesh filters. Their extruded ceramic filter line makes 1 million units. These numbers put us among China’s top filter suppliers.

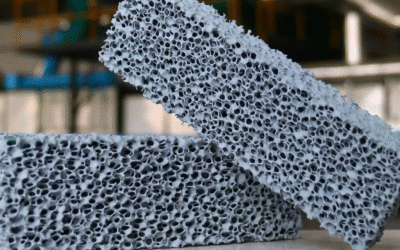

Product Portfolio for Aluminum Casting

They make three main filter types. Ceramic foam filters clean molten metal in foundries. They work across different casting methods. Fiberglass mesh filters are for aluminum foundries. These offer low-cost solutions. Extruded ceramic filters fit operations that need steady hole patterns and exact flow control.

They’ve filtered over 100 million pieces of metal castings since started. Both ferrous and non-ferrous metals. ISO certification backs our quality system.

Pricing and Trade Terms

Fiber glass filter samples start at US$0.50 per piece. Buy in bulk and the price drops. They offer flexible terms: FOB, EXW, CFR, and CIF. Extruded filters usually ship CFR. Got standard specs? You get immediate delivery. No waiting for production runs on common sizes.

Shandong Cast Care New Materials – Specialized Factory

Shandong Cast Care New Materials Co., Ltd. opened in 2021. CASTCARE is a newer player but built a 4,000-square-meter production facility. The facility makes precision casting filters. The factory sits in Shandong Province. This province is a key industrial zone in China for refractory materials.

Dual-Material Product Strategy

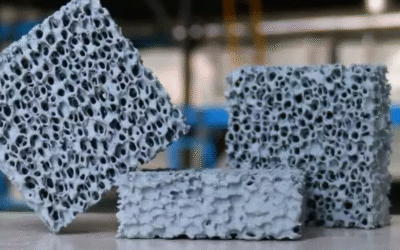

CASTCARE focuses on two core filter materials. Silicon carbide ceramic foam filters make up half the production line. Alumina ceramic filters fill the other half. You get options based on your casting needs.

Silicon carbide filters handle aggressive melts better. They resist thermal shock during rapid temperature changes. Alumina filters work well for standard aluminum casting. You get reliable filtration at lower cost per unit.

Size Flexibility and R&D Investment

They make silicon carbide foam filters in multiple sizes. Standard square sizes match industry filter boxes. Custom sizing is available for special casting setups. Their R&D team tests new filter shapes for better metal flow.

CASTCARE runs all operations under one roof. Manufacturing, sales, and research happen in the same facility. This speeds up product development. Need a custom filter spec? Our engineering team coordinates with production staff right away.

FoundryMax Filters – 20+ Years Experience Supplier

FoundryMax Filters brings 20 years of expertise in foam filter for aluminum casting. We run production lines for standard ceramic foam filters. Our range spans 10 PPI to 60 PPI specs.

Product Line Coverage

We make filters for all common aluminum casting methods. You get options for gravity casting, die casting, and low-pressure casting systems. Standard filter sizes run from 7×7 inches to 26×26 inches. Pick thickness from 25mm to 75mm based on your metal flow needs.

We stock filters in six PPI densities: 10, 20, 30, 40, 50, and 60 PPI. Lower PPI grades (10-30) work well for general aluminum alloy casting. Mid-range options (30-40 PPI) handle most auto and industrial jobs. High-density filters (50-60 PPI) work for precision casting that needs ultra-clean metal.

Manufacturing Capabilities

We run standard production cycles for regular orders. Our factory processes alumina ceramic materials with strict quality checks. Each filter batch gets purity testing before we pack it. We keep steady stock levels for common specs. This cuts down your wait time for standard sizes.

Need custom dimensions or special PPI mixes? We take custom requests for orders above minimum quantities. Our technical team checks your specs and gives you feedback within 48 hours.

Direct Purchase Channels and Contact Methods

Foam filter suppliers respond best to multiple contact methods. 77% of B2B buyers prefer email as their main outreach channel. But 49% favor phone calls for first contact. Match your method to the buying stage.

Email works as your main channel. Send your first inquiries to official company addresses on manufacturer websites. Include your casting specs, volume needs per month, and quality requirements. First follow-up emails boost responses by 50%. Contact suppliers within 5 minutes of getting their details. You’re 9x more apt to connect than if you wait hours.

Phone calls work faster for urgent needs. 82% of B2B buyers accept meetings from relevant cold calls. Call during China business hours (9 AM-6 PM CST). Ask for the export sales department. Prepare your questions: MOQ limits, lead times, sample policies. 57% of decision-makers prefer phone for technical talks.

LinkedIn builds relationships. Combine email with LinkedIn InMail for 11.87% response rates. Search “aluminum casting filters” or “ceramic foam filter export manager” to find supplier contacts. Companies using email-phone-LinkedIn together see 250% higher conversion rates.

WhatsApp and WeChat speed up responses. Over 65% contact suppliers via messaging apps. Open rates hit 98%+. Most Chinese manufacturers list WhatsApp numbers on their Alibaba profiles. Save supplier contacts and send spec sheets right away. Text message follow-ups generate 112.6% higher conversion than email alone.

Trade platform messaging gives instant access. Use Alibaba’s Trade Manager or Made-in-China’s inquiry system. These platforms track response times. Suppliers answering within 24 hours tend to maintain better service. Send inquiries to 5-8 verified manufacturers at once. This helps you compare quotes faster.

Video calls verify facilities. Request WeChat video tours or Zoom factory inspections before large orders. 73% of B2B organizations use virtual meetings for supplier checks. This cuts travel costs. Plus, it confirms production capacity.

Price Ranges and MOQ Comparison Across Suppliers

Aluminum casting foam filter prices shift based on supplier scale and order volume. Unit costs range from $0.50 to $28 per piece across China’s verified manufacturers. This 56x price gap exists for valid reasons—not just markup differences.

Price Tiers by Supplier Category

Small specialized factories quote $0.50-$3.00 per filter for basic alumina foam filters. These operations run 200-300 workers. They focus on standard PPI grades (10-30) with minimal customization. MOQ starts at 50-100 pieces. You get competitive pricing but limited technical support.

Mid-size manufacturers charge $3.00-$10.00 per unit. Plants like AdTech hold ISO certifications. They offer flexible specs. Their MOQ sits at 100-500 pieces depending on customization level. You pay more but get COA documentation. Plus, response times are faster.

Large industrial groups price filters at $8.90-$28.00 each. Baoding Ningxin and similar producers focus on high-volume buyers. Their MOQ jumps to 500-5,000 pieces. The higher cost covers premium alumina content (≥90% Al₂O₃). You also get strict tolerance control (±2mm) and DIFOT rates above 95%.

Hidden Cost Factors Beyond Unit Price

Calculate Total Cost of Ownership (TCO) before comparing quotes. A supplier quoting $5 per filter with 30-day sea freight may cost more than a $6.50 supplier offering 7-day air shipping. Factor in your casting schedule downtime costs.

Watch for price uniformity red flags. One supplier quotes 25% above the average? Request a detailed cost breakdown. Ask them to verify raw material costs against current alumina market indexes. A quote comes 25% below competitors? Probe shipping inclusions and lead time accuracy. Don’t mention “too low price”—this triggers price corrections upward.

MOQ Verification Steps

Cross-check quoted MOQ against your requested quantity. Mismatches signal supplier confusion about your specs. A factory states “MOQ 1,000 pieces” but you asked for 500-piece quotes? They didn’t read your RFQ.

Smaller factories with 200 workers handle low-volume orders better. Their overhead stays lean. A 1,500-worker plant needs higher MOQ to justify production line setup. Their profit margins depend on batch efficiency.

Negotiation Leverage Points

Request itemized quotes covering these five categories:

– Raw materials (alumina powder, binders)

– Direct labor (molding, drying, firing)

– Overhead (equipment depreciation, utilities)

– Logistics (domestic transport to port)

– Profit margins

Compare supplier margins against industry benchmarks. Aluminum casting filter producers add 15-20% markup over production costs. Margins exceeding 25% open room for negotiation. Target logistics and margin components—these flex more than raw material costs tied to commodity pricing.

Build an internal cost model using data from 3-5 suppliers. Check their raw material claims against current alumina oxide spot prices. This shows which suppliers inflate material costs versus those pricing at market rates.

Logistics and Import Tips for International Buyers

Container shipping from China is dropping fast through 2026. US imports hit 1.86 million TEU in December 2025—the slowest month since June 2023. January 2026 shows 2 million TEU, down 10.3% year-over-year. February drops to 1.86M (-8.5%). March falls to 1.79M (-16.8%). Full-year 2025 reaches 25.2M TEU, down 1.4% from 2024’s 25.5M.

Tariffs are changing where goods come from. China-US container imports dropped 20% year-over-year in November 2025. Airfreight from China fell 5%. Hong Kong routes declined 14%. Vietnam-US volumes jumped 15.4%. Thailand surged 27.2%. Indonesia climbed 18%. Southeast Asia air cargo to the US rose 42% in November—Taiwan up 40%, Vietnam 52%, Thailand 37%.

Ship now before prices go up. China-North Europe rates increased 10% in week 50 to USD 276 per 40-foot container. China-Mediterranean jumped 19% to USD 874. US-bound rates are dropping on both coasts. Asian and European demand is lower. But trucking costs will spike with double-digit rate increases in 2026. Carrier capacity is shrinking.

Watch these major ports (excluding Charleston): LA/Long Beach, Oakland, Seattle/Tacoma, NY/NJ, Virginia, Savannah, Everglades, Miami, Jacksonville, and Houston. Volume data from each port helps you time your shipments better.

Digital rules become required by 2026. WCO standards need consistent shipping papers. Customs systems must work together. ESG tracking now covers full logistics chains. Security rules get stricter. Compliance gets tighter. Confidentiality rules expand across all borders.

AI tools cut inventory 30%. They boost service levels 20%, MIT research shows. You can use AI for demand forecasting. Run lead time tests. Check geopolitical risks. Find better routes. Over 70% of North American shippers now share transport data with their operations. More than 50% share visibility with their suppliers.

Conclusion

Finding reliable suppliers for foam filters for aluminum casting in China is easier than you think. This guide shows you five verified manufacturers. FoundryMax offers specialized ceramic foam solutions. Cangzhou Sefu Ceramic provides industrial-scale production. Each brings different benefits in pricing, minimum order quantity, and technical support.

Three steps lead to a successful purchase: Check product specs against what your casting needs. Get samples for hands-on testing before placing bulk orders. Compare total costs including shipping, not just unit prices. Buying 100 pieces or 10,000? Direct contact with manufacturers gets you better pricing and custom options.

Your next move: Contact 2-3 suppliers from this list. Share your filtration needs (mesh size, dimensions, aluminum alloy type). Ask for technical data sheets and samples at the same time. Most manufacturers reply within 24-48 hours. They can give you quotes based on your production volume.

The right foam filter partner does more than deliver products. They join your quality control process. This means cleaner castings and fewer defects for years ahead.