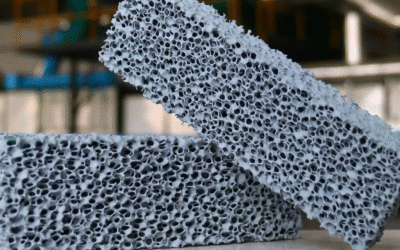

Finding reliable ceramic foam sources in the United States? It can feel like searching for a needle in a haystack. This is true when you need specific grades for filtration, insulation, or industrial use.

You might be a foundry manager sourcing aluminum filtration systems. Or an engineer specifying refractory materials. Maybe you’re a procurement specialist comparing suppliers. Knowing where to buy ceramic foam in the USA saves you time. It also helps you avoid expensive mistakes.

Where To Buy Ceramic Foam In The USA

The US ceramic foam market hit $109.9 million in 2023. This makes it the top manufacturing hub in North America. You get direct access to leading suppliers. Plus, delivery times beat international sourcing.

Five major domestic manufacturers control 63% of global revenue. SELEE Corporation leads in foundry filtration. They specialize in gating system designs. Saint-Gobain runs expanded New York facilities. Their focus? Catalyst supports and automotive exhaust filters. CoorsTek and Applied Ceramics handle diverse industrial ceramics needs. Honeywell holds a strong market spot too.

Material specs matter for your purchase. Silicon carbide takes 45.18% of the market share. Why? It stays stable above 1,500°C. This is key for molten aluminum work. The replica/polymer sponge process brings in 67.24% of production revenue. It delivers the 30-80 PPI (cells per inch) range foundries need.

US buyers get geographic perks. Midwest iron foundries and East Coast manufacturing hubs serve as distribution points. This setup supports the 34.6% foundry/metal casting market share. Automotive EV aluminum casting drives 39.61% of filtration uses.

The market has moderate consolidation. So, strong ties with these suppliers give you better technical support. You also get custom engineering help that beats overseas options.

Top US Manufacturers & Direct Suppliers

Most US ceramic foam comes from major industrial states. Texas leads with $808 billion in manufacturing shipments. California follows at $656.1 billion and Ohio at $374 billion. These regions house the main ceramic foam suppliers you’ll work with.

SELEE Corporation sets the standard for foundry ceramic filters. Their North Carolina plants make aluminum and iron casting filtration systems. You’ll see their custom gating designs in Midwest automotive plants. Their technical team comes to your site for installation support. International suppliers can’t offer this service.

Saint-Gobain’s New York plant makes high-temperature catalyst supports. They produce zirconia and alumina-based foams for chemical processing. Their products range from 10-65 PPI specs. Standard grades take 3-4 weeks. Custom formulas need more time.

CoorsTek operates several plants for different industrial uses. Their silicon carbide foams filter molten metal in foundries. General Motors (1.2M units sold in 2025 YTD) and Ford (926K units) use these systems. You can pick density ranges from 0.3 to 0.6 g/cm³. This depends on your flow rate needs.

Applied Ceramics makes refractory-grade materials. Steel mills and high-temperature furnace makers buy their product lines. They stock inventory in regional centers. Midwest buyers get deliveries in 5-7 business days.

Honeywell’s advanced materials division makes engineered ceramic foams. Aerospace and defense contractors are their main customers. But you can buy through their industrial channel if your application qualifies. Their ISO 9001 and AS9100 certifications meet tough quality standards.

Buying direct from manufacturers gives you three benefits: custom engineering support, consistent batch quality, and faster problem solving. Most need minimum orders of 50-200 pieces. This varies by specs. Order 500+ units per year and pricing drops 15-25%.

Online Purchase Platforms & E-commerce Options

E-commerce platforms handle $6.42 trillion in retail sales worldwide in 2025. Buying ceramic foam online is different from ordering regular consumer goods. Industrial platforms focus on verified suppliers and technical specs. Flashy product photos take a back seat here.

Amazon Business leads US industrial purchasing with 37.6% of total ecommerce market share. You’ll find ceramic foam filters from verified sellers like MSC Industrial Supply and Grainger. Search “ceramic foam filter” plus your PPI rating (10, 20, 30, or 60 PPI). Prices range from $8-45 per piece. Size and material grade affect the cost. Prime Business accounts get 2-day delivery on stocked items. The platform shows real-time inventory. Bulk pricing negotiations happen right through the interface.

Alibaba.com connects you to 50+ verified ceramic foam manufacturers. Filter by “Trade Assurance” badge. This protects orders up to $500,000. US buyers usually order 100-500 piece minimums at $3-12 per unit. Shipping from China takes 18-25 days by ocean freight. Request material certificates (ISO 9001, ASTM standards) before placing large orders. The platform’s mobile app handles 60-74% of global ecommerce traffic in 2026. Quote comparisons get easy from your phone.

ThomasNet serves 1.3 million North American industrial buyers each month. Their verified supplier directory lists 15+ US ceramic foam makers with RFQ systems. Submit specifications once. You receive 3-5 competitive quotes within 48 hours. No transaction fees. The platform serves B2B connections—part of the $32.11 trillion global B2B ecommerce market in 2026.

IndiaMART works well for budget buyers. Indian suppliers offer silicon carbide foam at $2-8 per piece with 200+ unit minimums. Quality varies a lot. Request samples before placing production orders. Payment through the platform’s escrow service adds protection. This increases costs by 2-3%.

McMaster-Carr and MSC Industrial Direct stock small quantities for prototyping. Expect $25-65 per piece for quick shipment. Their technical datasheets match OEM specifications. No guesswork needed. Cart abandonment rates hit 70% across ecommerce with unexpected shipping fees. These suppliers show total landed costs upfront.

Most platforms accept digital wallet payments (51.7-61% of global ecommerce by 2026). BNPL options are available too. US buyers spent $133 billion through buy-now-pay-later services. This spreads ceramic foam investments across budgets by quarter. No interest charges.

Ceramic Foam Material Types & Specifications Available in USA

US suppliers stock six main ceramic foam materials: silicon carbide (SiC), alumina (Al2O3), zirconia (ZrO2), silicon nitride (Si3N4), titania, and silica. Each material fits different industrial uses based on heat limits and chemical resistance.

Silicon carbide foam dominates metal casting markets. ERG Aerospace’s Duocel® brand sets industry benchmarks with these specs:

-

Compression strength: 2800 psi (19 MPa) bulk, 1000 psi (6.9 MPa) ligament-specific

-

Temperature ceiling: 1700°C with strong thermal shock resistance

-

Porosity range: 94-96% open-cell structure gives minimal pressure drop

-

Mechanical properties: Young’s modulus hits 4 × 10^5 psi (2.76 GPa), Mohs hardness reaches 9

-

Shear strength: 700 psi (4.8 MPa) handles turbulent molten metal flow

Alumina foam offers affordable high-temperature solutions. The sponge manufacturing method makes it easy to access. Crush strength tops out at 80 MPa with 25 MPa modulus. Maximum operating temperature at 1200°C. This material works well in both oxidation and reduction environments.

Zirconia foam handles special corrosion jobs. Its high-temperature stability and strong corrosion resistance justify the premium price. Chemical processing plants use this material. Extreme environment filtration systems also specify it.

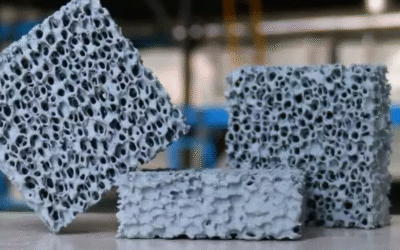

Customization Capabilities

Stanford Advanced Materials and ERG Aerospace machine custom shapes. They use diamond cutting tools and grinding wheels. This creates geometries that fit specific installations.

Porosity control spans 70-96% through precise processes. SiC foams use vapor deposition on carbon templates. Al2O3 and ZrO2 variants use impregnation and sintering methods.

Production scales from prototype runs to high-volume manufacturing. Lead times vary by spec. Standard specs ship in 3-4 weeks. Custom formulations need 6-8 weeks for tooling and testing.

Industry-Specific Suppliers

Different industries need special ceramic foam grades. General suppliers can’t match these requirements. Foundries need filters that handle molten aluminum pour rates. Aerospace makers require AS9100-certified structural foams. Research labs want ultra-pure samples for controlled tests. Specialized suppliers know these needs and provide the right solutions.

Casting Industry Solutions: FoundryMax CFF Product Line

FoundryMax Corporation built its name on foundry filtration. Their Ceramic Foam Filters (CFF) reduce metal inclusions by 90-95% in aluminum casting operations. This performance cuts scrap rates. Plus, it improves casting surface quality.

Their product range covers 30-80 PPI porosity ratings for steel and aluminum foundries. A standard 10×10-inch filter costs $5-50 depending on PPI grade and volume. The price includes custom porosity matching to your metal chemistry and pour temperature.

Aerospace-Grade Precision: ERG Duocel

ERG Aerospace holds AS9100D certification and NADCAP accreditation for heat treatment processes. Their Duocel® foam meets strict AMS (Aerospace Material Specifications) standards for structural use. Commercial aerospace suppliers can’t use non-certified materials. ERG solves this problem.

Duocel foams range from 8-40 PPI density with 5-25% relative density. Aerospace heat exchangers use these specs for maximum heat efficiency at minimum weight. Structural foam costs $100-500 per kilogram in 2025. The premium price reflects certified material traceability and batch testing documents.

ERG operates vendor-managed inventory (VMI) programs for aerospace OEMs. They also support low-volume prototype runs that large makers reject. Small aerospace startups benefit from 10-piece minimums instead of 1,000-unit requirements.

Laboratory & R&D Specialty Suppliers

American Elements supplies 99.9999%+ purity ceramic foams for research use. Their aluminum, titanium, and ceramic foam products come with ICP-MS (Inductively Coupled Plasma Mass Spectrometry) purity certificates. Custom CFF-type porous media starts at 1-gram quantities for $50-300 per 100 grams.

Material scientists testing filtration theories need this purity level. Industrial-grade foams contain trace contaminants that skew test results. American Elements ships worldwide with express options for time-sensitive research.

Stanford Advanced Materials (SAM) focuses on 99.99%+ refractory metals and ceramic foams. Their zirconia and silicon carbide products span 10-60 PPI grades for lab-scale filtration studies. Minimum orders start at 100 grams for $40-250. Bulk discounts apply above 1kg.

Regional Distribution & Local Availability

Ceramic foam suppliers now use multi-location networks across the United States instead of single national warehouses. This changes where you buy ceramic foam in the USA and speeds up your orders.

Manufacturing hubs cluster around industrial areas. Texas has several ceramics makers that support the state’s $808 billion manufacturing sector. Colorado and other Mountain West states show rising ceramic foam demand from construction and aerospace makers.

Shipping limits hit some regions harder. The Southeast, Texas, and Mountain West saw low shipping volumes in 2025. These same areas face tight capacity through 2026. Construction growth and factory expansion push freight rates up 10% or more in busy shipping lanes. Lock in multi-year supply deals now. This helps you avoid 2026 price jumps.

Spread-out warehouses cut shipping costs up to 15%. Big suppliers run regional storage centers close to their customers. No more single national warehouses. CoorsTek’s Midwest storage hubs get products to auto foundries in 5-7 business days. Saint-Gobain’s East Coast sites deliver to chemical plants faster than West Coast shipping can.

Regional shipping partners add flexibility. Smart suppliers work with several local freight companies instead of one national carrier. This setup guards against problems and keeps prices competitive. Order 200+ pieces every three months? You qualify for special regional shipping rates that cost 12-18% less than standard LTL pricing.

Price Ranges & Cost Factors

Ceramic foam prices in 2025 show big jumps in material costs. Market conditions are shifting fast. ERG Aerospace’s Duocel® foams cost $299–$419 per unit for standard industrial grades. Use this as your baseline. Compare it across USA suppliers.

Construction materials for ceramic foam production jumped +5.2% year-over-year from January through August 2025. Since 2020, the total increase hits +52%. This hits silicon carbide and alumina foam pricing hard. Suppliers handle these costs in different ways. Production efficiency matters. So do contract structures.

Volume-Based Pricing Structures

Order size affects your savings. Tiered commission models are now standard across industrial suppliers. Manufacturing and industrial sectors work on 1–5% sales commission rates in 2026. Retail margins run 10–20%, much higher. The tight spread means volume discounts come from production efficiency. Not random markups.

Order 50–200 pieces? You’ll pay close to the $299–$419 benchmark. Scale to 500+ units per year and manufacturers cut prices 15–25%. This comes through preferred customer deals. Multi-year contracts help too. Get deliveries of 200+ pieces every three months. This unlocks regional freight discounts worth 12–18% savings on landed costs.

How to Contact Suppliers & Request Quotes

You have three ways to reach ceramic foam suppliers: online forms, direct email, or phone calls. Phone works best for urgent requests. Grab the number from their company profile page. Talk to their technical sales team right away.

Your RFQ (Request for Quote) needs three parts for fast, accurate responses:

-

Application scenario – Tell them your use: molten metal filtration, catalyst support, or thermal insulation

-

Technical specifications – List PPI rating (10-80 range), material type (SiC, alumina, zirconia), dimensions, and temperature needs

-

Order quantity – State your initial volume and yearly usage

Keep it simple. 53% of suppliers respond faster to easy-to-read formats. Use bullet points, not long paragraphs. Send technical drawings as PDFs, not CAD files.

Expected Response Timelines

Strategic suppliers take 4-8 weeks for custom engineering quotes. SELEE and ERG fit this category. Standard suppliers respond in 2-4 weeks for catalog items. Distributors stocking common PPI grades fall here too.

B2B buying cycles average 11.3 months for industrial materials. 80% of buyers make contact at the 70% journey point. Start requesting quotes during your planning phase. Don’t wait until production deadlines approach.

What Suppliers Need From You

Share accurate lead time expectations and purchase forecasts up front. Suppliers favor customers who give 6-12 month demand projections. Switching vendors? Include past pricing benchmarks. This speeds up talks.

Track how fast suppliers respond. Use a simple scale: Very responsive to Not responsive. Note delays in docs or technical answers. Good communication cuts your total procurement costs. Manual onboarding costs $35,000 in hidden fees on average. US domestic suppliers reduce this to $12,000 through faster processes.

Get material samples before placing production orders. Check fulfillment rates. Compare their certifications against real test data. Most suppliers ship 100-gram samples in 3-5 business days. Cost runs $40-150 based on material grade.

Comparison: Domestic vs Import Options

Import prices dropped 0.1% from December 2024 through May 2025. Domestic PCE goods rose 0.4%. The price gap looks good at first. But it vanishes once you add up all costs for ceramic foam.

Tariffs hit imported ceramic foam harder than domestic options. Imported goods retail prices jumped 5.4% in 2025. Domestic products rose just 3.0%. Core imported goods climbed 1.7% above pre-2025 trend lines. Durables—ceramic foams included—surged 2.1% higher. Foreign producers absorbed almost no tariff costs. US buyers pay the full burden.

Shipping costs swing wildly on imports. Every 1% rise in shipping costs pushes import prices up 0.43% on average (2016-2024 data). The COVID shipping crisis drove import prices up 4.7 percentage points. The 2024 surge added another 2.4 points. Real goods imports fell 7.2% in August 2025. This signals tighter capacity and higher freight rates ahead.

Small orders work better with domestic suppliers. Forty-five percent of imports serve as inputs for US production. Small buyers get hit with customs processing delays and high minimum order quantities. Domestic suppliers ship 100-piece orders in 5-7 days. Import minimums start at 200-500 pieces. Ocean freight takes 18-25 days.

US manufacturers deliver more consistent quality. Domestic production follows CPI/PPI patterns closely. No sourcing swings. Import price history shows 10-percentage-point deflation from supplier shifts during the 2000s. Post-2010 moves away from Chinese sources created price pressure. Batch-to-batch specs vary more with international suppliers. They change sub-contractors often.

Buy domestic ceramic foam for fast delivery, small quantities, or stable pricing. Choose imports for large-volume contracts where 500+ unit orders justify customs hassles and shipping risks.

Conclusion

Finding the right ceramic foam supplier in the USA doesn’t have to be hard. Need high-purity alumina foam for metal work? Looking for zirconia types for aerospace projects? This guide covers your complete buying path. You’ll find established makers like Selee Corporation and Vesuvius, plus online platforms and local distributors.

Match your technical needs with the right supplier channel. Direct maker relationships give you custom options and bulk pricing. E-commerce platforms work great for smaller orders. Do your homework: check ISO certifications, ask for material test reports, and compare US and import choices. This helps you balance cost and quality.

Ready to source ceramic foam? Request quotes from at least three suppliers in your category. Give them details: pore size, temperature needs, and how you’ll use it. This gets you accurate pricing. The suppliers in this guide serve US customers now—your ideal ceramic foam solution is one inquiry away.

The right supplier isn’t just about price. You need steady quality, technical help, and reliable delivery times that keep your work on track.